Technology Adoption and Collateralized Loans in Kenya

- Farmers

- Technology adoption

- Credit

Policy issue

In contexts without well-developed formal credit markets, weak legal institutions and difficulties in contract enforcement can induce lenders to impose restrictive borrowing conditions in low-income countries as a way to reduce credit risk. However, doing so can overly limit farmers’ access to credit and hamper investment and technology adoption.

Little research exists in low-income countries on the feasibility of asset collateralized loans, in which the asset purchased with the loan is used as collateral to reduce risk to the lender. In many countries with highly developed credit markets, loans for making large investments—such as buying houses or business equipment—use the assets themselves as collateral. This means that the lender will repossess the asset if the borrower fails to repay the loan. In comparison, fewer lenders offer asset collateralized loans in low income countries, and when they are available, borrowers typically must make large down payments. Can relaxing borrowing requirements expand access to credit and increase technology adoption among farmers without incurring too much risk for the lender?

Context of the evaluation

Approximately one million smallholder dairy farmers reside in Kenya. Reliable access to water is crucial for these farmers because dairy cattle require a regular water supply. In the Central and Rift Valley provinces where the study took place, only about 30 percent of farmers had access to piped water systems. Without easy access to piped water, the most common way to water cattle is to bring them to a water source every two or three days. Fetching water is a task that women and girls disproportionately carry out, spending three times longer per day on this task than men. One solution to create convenient access to water are rainwater harvesting tanks. Lightweight, plastic rainwater harvesting tanks were introduced to the local market ten years before the study. Many farmers prefer these new tanks to stone or metal tanks, the traditional way to store water. However, plastic rainwater tanks cost about US$320 or 20 percent of annual household consumption, so few farmers can afford to install them.

Farmers in this study sold milk to a dairy cooperative, the Nyala Dairy Cooperative, as their primary source of revenue. The cooperative has an associated savings and credit association (SACCO) where members can purchase agricultural inputs and services on credit as well as take out cash loans to cover other costs like education. Yet, SACCOs tend to impose tight borrowing requirements to avoid defaults.

Details of the intervention

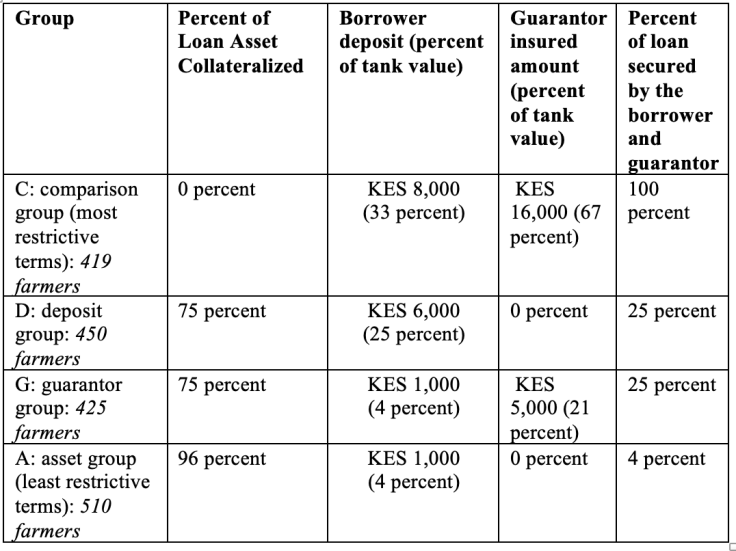

In partnership with Nyala Dairy Cooperative, researchers evaluated the impact of offering asset collateralized loans for rainwater harvesting tanks on both credit access for dairy farmers and loan repayment. Researchers offered 1,804 dairy farmers one of four randomly assigned loan contracts valued at KES 24,000 (US$320 at the time of study) to purchase a 5,000-liter rainwater harvesting tank. The different groups are summarized below:

Farmers were offered the various loan types between March and September of 2010. If a farmer could not make repayments, the cooperative would repossess the tank after 4.5 months and sell it to cover the farmer’s loan obligations. To measure the impact of the loan terms on take-up, repayment, and tank repossession, researchers obtained administrative data from the cooperative. Researchers also collected and data on milk sales from the cooperative and visited farmers to collect survey data on the production and sale of milk, consumption, child health, water sources, time use by household members, and school enrollment.

Results and policy lessons

Using the tanks as loan collateral increased loan take-up for farmers without worsening repayment or leading to losses for the SACCO and allowed farmers to invest in an agricultural technology.

Access to credit: Asset collateralization increased take-up of the loans. Among comparison group (group C) farmers offered a standard 100 percent secured joint-liability loan, 2.4 percent took out a loan. By contrast, 27.6 percent of farmers in group D and 44.3 percent in group A, the least restrictive group with near total asset collateralization of the loan, took up a loan. This difference in take-up rates implies that the standard SACCO borrowing terms would have prevented at least 95 percent of potential tank purchasers from taking up loans.

Joint liability (group G) did not increase loan take-up relative to farmers in group D, where a deposit of the same total value was required. This finding suggests that joint liability, a key feature of many microcredit programs, isn’t necessary for loan repayment. The authors note that addressing regulatory barriers to asset collateralization may thus be a more effective approach to expanding credit access.

Loan repayment and recovery: No farmers defaulted on their loans and no tanks were repossessed, except in one instance in group A. This represents a default rate of just 0.7 percent among those farmers who borrowed under the least restrictive conditions. In this instance, the cooperative repossessed the tank. Farmers in groups A, D and G were more likely to make late payments throughout the loan cycle and have outstanding balances at the end of the loan, compared to group C. However, the amount that was not paid on time was very small across groups, and farmers in groups A, D, and G paid these outstanding balances within a few days. Ultimately, asset collateralization did not negatively impact the lender’s bottom line.

Tank ownership: Farmers in group A increased their ownership of large plastic tanks by 30 percentage points, compared to group C where 18 percent of farmers owned large plastic tanks (a 166 percent increase).

Milk Sold: Farmers offered favorable credit terms (groups A, D, and G) were 4.5 percentage points more likely to sell milk to the dairy cooperative, compared to group C, where 40 percent of farmers sold milk to the cooperative (an 11 percent increase).

Impact on school enrollment: The offer of asset collateralized loans to households in group A increased the probability that girls were enrolled in school by 2 percentage points relative to the comparison group, resulting in near universal enrollment by the end of the study. However, the authors note that this finding did not hold up consistently in all aspects of their analysis and advised caution in interpreting results on school enrollment.

The study’s findings influenced SACCO to offer asset-collateralized loans for 5000-liter water tanks marked at retail price, with a small administrative charge of KES 700 (US$9) and a 20 percent deposit requirement. Thirteen other SACCOs have chosen to implement similar programs, a change that may allow for wider adoption of rainwater harvesting tanks and other agricultural technologies among the members of the cooperative.