Financial Diaries and Education to Improve Women's Financial Literacy in Rural Bangladesh

- Women and girls

- Empowerment

- Household finance

- Women’s/girls’ decision-making

- Self-esteem/self-efficacy

- Credit balance/repayment

- Savings/deposits

- Financial literacy

- Training

- COVID-19 response

Women in low- and middle-income countries often have low levels of financial literacy, which can be key to increasing women’s bargaining power within the household and access to economic opportunities. In rural Bangladesh, researchers conducted a randomized evaluation to assess the impact of teaching women to track spending in financial diaries and providing a traditional financial education program on their financial literacy and well-being. Women had higher financial literacy levels after receiving either intervention and improved their savings behavior and debt management, though their exposure to formal financial institutions remained the same. Participants who received financial diaries were also more empowered to make financial decisions.

Problema de política pública

Financial literacy, the ability to make effective and informed decisions regarding resource management, is critical to increase women’s access to economic resources and opportunities, as well as their bargaining power within the home—two key drivers of women’s empowerment. However, women in low- and middle-income countries often have little knowledge of financial concepts and risks, as well as limited skills to manage their household finances.

Financial education programs have been adopted in multiple settings as a means to increase women’s financial literacy and well-being, but they can be expensive and are not always effective in promoting financial inclusion. Can a cheaper, alternative intervention, such as maintaining a financial diary, increase financial literacy and well-being for women in rural Bangladesh? Are financial diaries more effective in improving financial literacy than traditional financial education programs?

Contexto de la evaluación

In Bangladesh, a 2016 survey found that less than 40 percent of respondents passed a minimum score of a financial literacy assessment, and showed the existence of a gap in financial knowledge between genders. Such low levels of financial literacy can translate into lower financial inclusion, especially for women. For instance, about 65 percent of men and 36 percent of women in rural Bangladesh had access to bank accounts in 2017 (at the time this evaluation was conducted). Despite the increasing penetration of formal credit institutions across rural areas, informal savings and loans remain dominant sources for financial support in these regions.

This study took place in rural areas in two southwestern Bangladeshi districts, Khulna and Satkhira. All participants were married women aged 18 to 40, and less than 15 percent of them had an income-earning job. Approximately three-quarters of eligible households were saving money. By design, none of the participants were illiterate and the majority could perform basic calculations. Approximately half were members of local NGOs or MFIs, but less than 40 percent had an active bank account.

Detalles de la intervención

In collaboration with Khulna University and local NGOs, researchers conducted a randomized evaluation to assess the impact of teaching women to track spending in financial diaries and providing a traditional financial education program on their financial literacy and well-being. To begin, they randomly assigned 150 villages to participate in one of three possible interventions. Within these villages, 2,364 married women were randomly selected and invited to participate in the study. The interventions were conducted as follows:

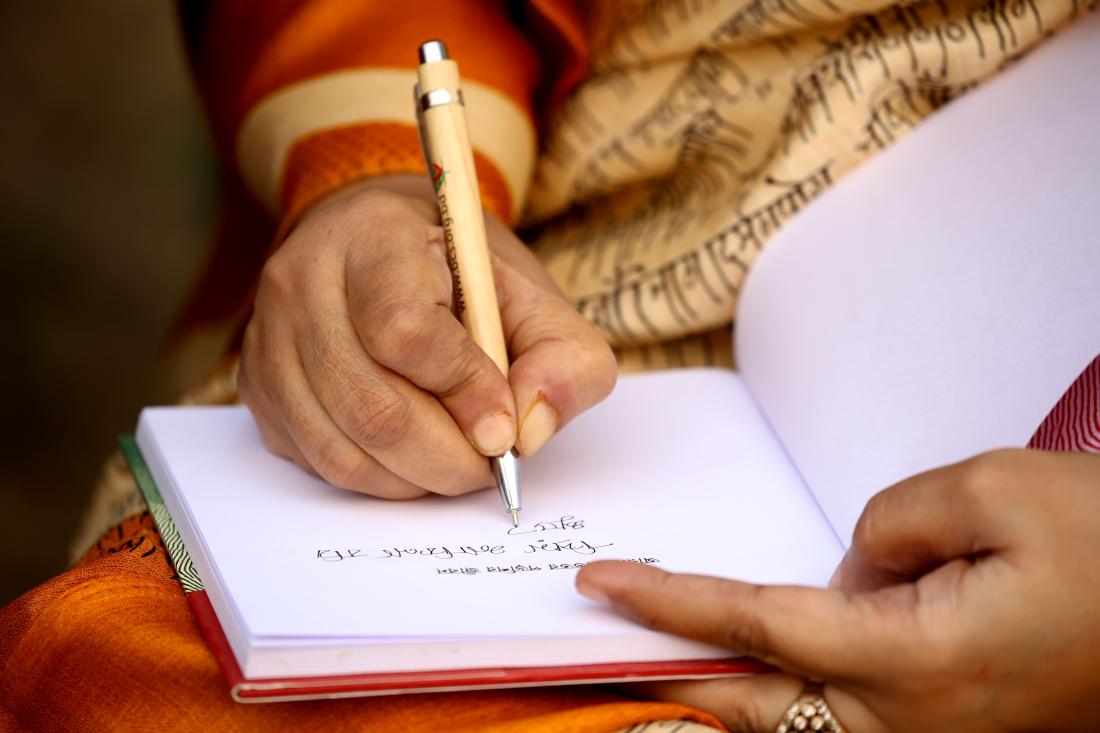

- Financial diary: Women from the fifty villages assigned to this group received visits from field workers who offered them a financial diary and taught them how to maintain the diary. The financial diary had two main columns which participants used to record daily cash inflows (income/borrowing) and outflows (expenditure/lending). Participants were asked to self-record their household’s daily income and expenditure in the diary for a thirty-week period. Field workers re-visited households every two weeks to collect and cross-verify the diary entries, as well as to answer questions on how to use the diary.

- Financial education: Women from the fifty villages assigned to this group were invited to take part in a short course on basic financial knowledge that occurred over five-hour sessions once a week for six consecutive weeks. Each session entailed one lecture and group discussion with graphical illustrations and field exercises, and covered one of six topics: budgeting, savings, debt, informal and formal financial services, dealing with financial emergencies, and saving for old age.

- Comparison: Women from fifty villages were not offered either intervention.

Researchers evaluated the interventions’ impacts on financial literacy, downstream financial behavior, and financial empowerment. They used two metrics of financial literacy in the study: (i) a financial literacy index that aggregated metrics of financial knowledge (the understanding of financial topics), and (ii) a financial self-efficacy scale, which captured women’s ability and confidence to apply the knowledge to financial activities. The metrics were estimated using participants’ responses to a test about basic financial concepts, awareness of practices associated with positive financial behavior, and financial confidence. To test if financial knowledge led to further behavioral change, researchers observed: (i) a savings index that aggregated indicators on savings amounts and frequency; (ii) a debts index that captured good debt management practices; and (iii) and an index of exposure to formal financial institutions.

Information on women’s financial empowerment came from two sources. One was self-reported data on how influential women were in decisions regarding household expenditures. Second, researchers conducted an experimental game with a sub-sample of 570 study participants that simulated the processes of intra- and extra-household decision-making. In this game, participants were asked to make decisions regarding a lottery investment together with either their spouses or a random man from the village. After observing women’s preferences for the lottery allocation, researchers measured women’s willingness to overrule their husband or other men, by checking their likelihood of changing an investment decision made by the partner when given the chance.

Researchers also conducted a follow-up survey with study participants one year after the interventions ended or eight months after the Covid-19 pandemic started. They used the survey responses to document long-term effects on participants’ financial well-being and whether the interventions helped them cope with the Covid-19 crisis.

Resultados y lecciones de la política pública

Women had higher financial literacy levels after receiving either of the interventions and improved their savings behavior and debt management, though their exposure to financial institutions remained the same. In the lottery game, participants who received financial diaries demonstrated more empowered attitudes, overruling their spouses’ investment decisions more often. These impacts lasted one year after the intervention, and women who participated in either program coped better with the consequences of Covid-19 relative to women in the comparison group.

Take-up: There was meaningful uptake of and consistent participation in both interventions. About 83 percent of women in the financial education group took part in all the training sessions, and around 88 percent of those offered a financial diary initially agreed to maintain the diary, of whom 84.5 percent kept the diary for the entire thirty-week period.

Financial literacy: Financial knowledge similarly increased with both programs, but only women in the financial education group demonstrated higher financial self-efficacy after the intervention. Women in the financial education and financial diary interventions experienced improvements of 0.28 and 0.24 standard deviations in the financial literacy index relative to the comparison group, respectively. However, only those in the financial education program improved financial self-efficacy, experiencing a 0.29 standard-deviation increase in the financial self-efficacy scale with respect to the comparison group.

Downstream financial behavior: Women in both interventions improved their savings behavior and debt management, but their exposure to financial institutions did not change. In both groups, there was an increase of 0.16 standard deviations in the savings index and 0.11-0.12 standard deviations in the debt index relative to the comparison group. On the other hand, exposure to formal financial institutions remained the same as in the comparison group. Researchers suggest that better savings and debt behavior did not translate into higher usage of formal financial services due to participants’ limited access to banks, resulting from women’s mobility constraints and the long distances to local branches.

Financial empowerment: There was limited improvement in financial empowerment according to self-reported information, but women who were trained to use financial diaries demonstrated greater empowerment in the lottery game. Women in the intervention groups were no more likely than those in the comparison group to report being the sole decision-maker in the household, and only women in the financial education group became more likely to be a joint decision-maker (a 0.22 standard-deviation increase relative to the comparison group).

Meanwhile, participants in the financial diary intervention who played the lottery game were 14.3 percent more likely to overrule their partners’ decisions relative to the comparison group and chose to deviate from their partners’ investment level by twice as much as women in the comparison group. By contrast, recipients of the financial education program did not respond to the game differently from the comparison group.

Long-term effects and resilience during the Covid-19 pandemic: The positive impacts on financial well-being were long-lasting for women who participated in the two interventions; they were shown to be better equipped to cope with the economic and health consequences of the Covid-19 pandemic a year after the intervention. Relative to the comparison group, participants in both the financial diary and financial education interventions were similarly less likely to skip meals, miss out on medical care, fail to pay utility bills, sell assets, or require outside help.

Cost-effectiveness: Financial diaries were more cost-effective in improving financial outcomes than financial education. While both interventions had similar effects on financial outcomes, financial diaries cost under half as much (US$15 per participant) as financial education (US$32 per participant). This suggests that financial diaries were more cost-effective overall and can be a simple alternative to traditional financial education in improving the financial well-being of vulnerable populations.