Indonesians are turning to digital financial services during the COVID-19 pandemic

Social distancing guidelines in Indonesia and around the world have profoundly impacted many aspects of people’s lives, from the way we communicate to the ways we work, shop, and transact. These shifts have brought the potential of digital financial services (DFS) as a means of easing some of the economic consequences of the COVID-19 shock in Indonesia to the forefront.

While anecdotal evidence suggests DFS adoption is on the rise nationwide, policymakers lack concrete evidence on how widespread adoption is and what new users’ experiences look like. To examine whether the pandemic has increased the use of DFS in Indonesia, J-PAL Southeast Asia’s Inclusive Financial Innovation Initiative (IFII) team collaborated with an Indonesian government partner to conduct an online survey on DFS adoption.

The survey was conducted through Google Surveys, which uses convenience sampling to recruit people through mobile phone and computer-based Google platforms. Accordingly, the sample is skewed towards people who are digitally engaged, often considered as an important target group for DFS conversion.

Increased DFS use during the pandemic

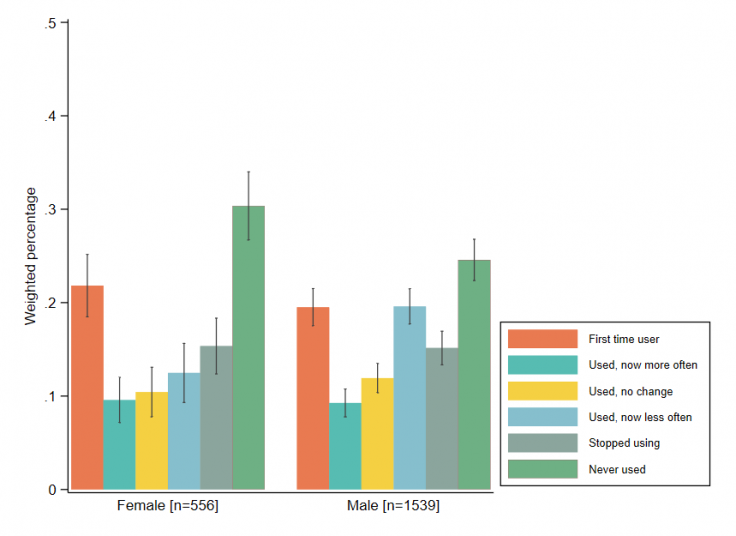

Notes: Results are weighted using SUSENAS 2019. The numbers in parentheses are sample sizes. Whiskers denote 95 percent confidence intervals.

Key findings

More people are using DFS during the pandemic. Twenty-one percent of men and 22 percent of women in the survey reported that they used DFS for the first time during COVID-19, while 15 percent of men and women reported that they stopped using DFS in this period.

As online platforms often offer discounts and shoppers can compare prices more easily than in physical stores, we found that the desire to find cheaper goods online is one of the biggest triggers of DFS adoption. Other drivers of use are the greater safety and convenience of online shopping, as well as the need to more easily transfer funds.

DFS users do not go fully digital. Sixty-two percent of DFS users use online platforms to buy primary goods like food and drinks, or secondary goods like clothing, books, stationary, and household utensils; however, 54 percent of online shoppers report cash is still their main payment instrument. The most common reported barriers for using electronic payment technologies like digital banking and e-money are a perceived lack of use cases, associated fees, and trust issues.

Promising signs of inclusion among harder-to-reach groups

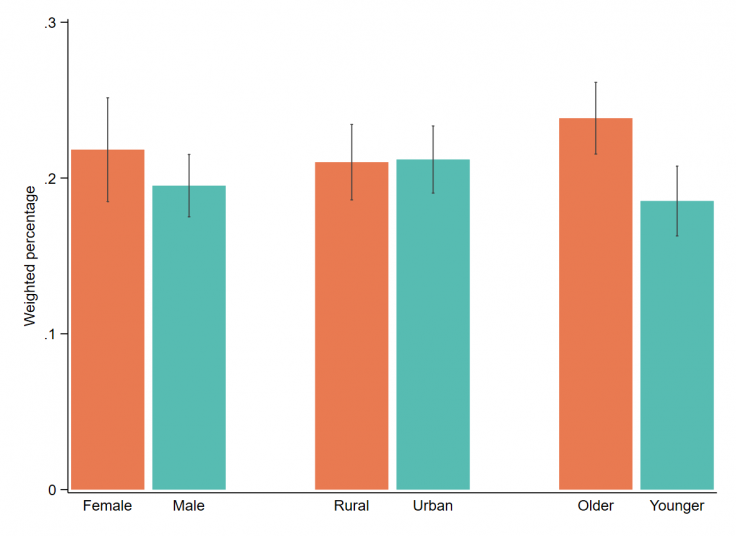

J-PAL’s survey suggests that women and rural dwellers are actively adopting DFS during the pandemic; moreover, older Indonesians (45+) have a higher take-up than the younger population—at least within the highly-selected Google Survey sample.

Notes: Results are weighted using SUSENAS 2019. Age category is split between the older group (45 and older) and the younger group (18 to 44 years old). Whiskers denote 95 percent confidence intervals.

Women and rural residents report being first-time DFS users at the same rate as men and urban dwellers, which is crucial to lift up who are more likely to be excluded from the financial system. Female DFS user are also more frequent online shoppers (84 percent of women versus 76 percent of men). Accordingly, online shopping could provide a compelling business case for women to adopt DFS after the pandemic abates.

Older individuals are more likely to convert to DFS. Twenty-four percent of people aged 45 and above are first time adopters, as compared to 19 percent of people aged 18 to 44. Part of this may reflect higher pre-pandemic use among younger individuals, who are often more digitally literate.

What can industry and policymakers do to support sustained DFS use among new adopters?

Pandemic-induced shifts in adoption are more likely to convert to meaningful longer-term engagement if new users have positive experiences early on.

Private sector players should pay attention to user onboarding and communication to ensure that getting started is easy. They could also ramp up promotion efforts by expanding incentives (discounts, cash-back, etc.) to create habitual DFS use. At the same time, government agencies could build on recent initiatives that leverage DFS for social protection payments.

Efforts now to help new users get comfortable and stay engaged may pay long-term dividends as Indonesians adjust to a “new normal” way of managing their finances and participating in the economy.

J-PAL Southeast Asia’s Inclusive Financial Innovation Initiative (IFII) is working alongside governments, private sector firms, and nonprofit organizations to understand how the COVID-19 pandemic has shaped the way people live and transact.

This blog post is based on effort funded by the Bill & Melinda Gates Foundation. The findings and conclusions contained within are those of the authors and do not necessarily reflect positions or policies of the Bill & Melinda Gates Foundation. The mission of IFII is to ensure that digital financial services can drive economic development while lifting up women, low-income groups, and marginalized communities.

You can review the detailed results of the online survey here. For more information about IFII, contact [email protected].