Information Disclosure, Cognitive Biases, and Payday Borrowing in the United States

- Adults

- Take-up of program/social service/healthy behavior

- Financial literacy

A belief that payday lenders prey on the financially illiterate has inspired strict regulation of the industry, but it is possible that borrowers are fully informed about the high fees associated with payday loans and yet still find them an attractive option. Researchers provided payday borrowers in the United States information about the true costs of payday loans in order to find out whether they would respond by changing their demand for the product. Better informed individuals reduced their demand significantly, suggesting that getting consumers to think more broadly about the decision to take up a payday loan may result in a reduction in the amount of payday borrowing.

الموضوع الأساسي

Low-income households often rely on non-mainstream financial products for access to credit. Payday loans, in which a borrower receives cash in advance and the lender receives a fixed fee of $15 or $17 for every $100 on the next paycheck date, are one popular option in the United States. However, when taken over a year, the fixed fee represents a very high interest rate, well over 400 percent. A belief that payday lenders prey on those who are financially illiterate or unsophisticated has motivated both state and federal legislation to set a maximum annual percentage rate (APR) on payday loans. However, there is little empirical research to date on whether such a predatory view of lenders is warranted. Individuals may be fully informed about the fees associated with payday loans and instead might decide to borrow from payday lenders at high interest rates because they face a pressing need for cash at the moment, in which case additional information about the payday product should not alter their borrowing behavior. In contrast, if all or a subset of payday borrowers are making mistakes, one might expect borrowing behavior to respond to how the cost and benefits of the payday products are disclosed.

سياق التقييم

Payday loan stores are required to display the fee schedule. The fees do not vary by the length of the loan or borrower risk, and the loan duration is set by the individual' s pay cycle; loans are always due on the next payday. The average loan size is approximately $350. To apply for a loan, the customer provides the lender, or more specifically, a customer service representative (CSR) with a physical copy of her latest bank statement and paycheck stub. If a loan is offered, the customer signs a form that discloses the terms of the loan and the information mandated by state laws, including the APR. Typically, the CSR then puts the cash and a copy of the paperwork inside a standard envelope and writes the payment due date and amount due on the calendar printed on the outside of the envelope. During the evaluation, this process was altered in two ways. First, as the customer handed the application and support materials to the CSR, the CSR asked the customer if she would like to participate in a short four-question survey in exchange for a year' s subscription to a magazine of her choice. Second, the CSR replaced the usual cash envelopes with custom envelopes printed with the information treatments described below.

معلومات تفصيلية عن التدخل

Researchers collaborated with a national payday lending chain to evaluate whether and how various ways to present information about the costs of payday loans impact individuals' decisions to continue borrowing from payday lenders.

All customers who visited the 77 randomly chosen stores over the course of 12 days were invited to participate in the experiment, with the treatment being offered varying by day. Of the 1,441 individuals who consented to participate in the evaluation, one-quarter served as a comparison group. The remaining participants were divided into three treatment groups to receive further information about the costs of their loans:

- APR Information: The APR was printed directly on the cash envelope, along with a comparison to other familiar rates such as mortgages and credit cards, which are much less expensive.

- Dollar information: The cash envelope included a comparison chart of payday loans and credit cards in terms of dollar costs, rather than annual interest rates. For example, whereas the dollar cost in interest of using a credit card to finance $300 of debt is $2.50 for 2 weeks and $15 for 3 months, the cost in fees for a payday loan is $45 for 2 weeks and $270 for 3 months.

- Refinancing information: The cash envelope included a simple graphic of the typical repayment profile for payday borrowers.

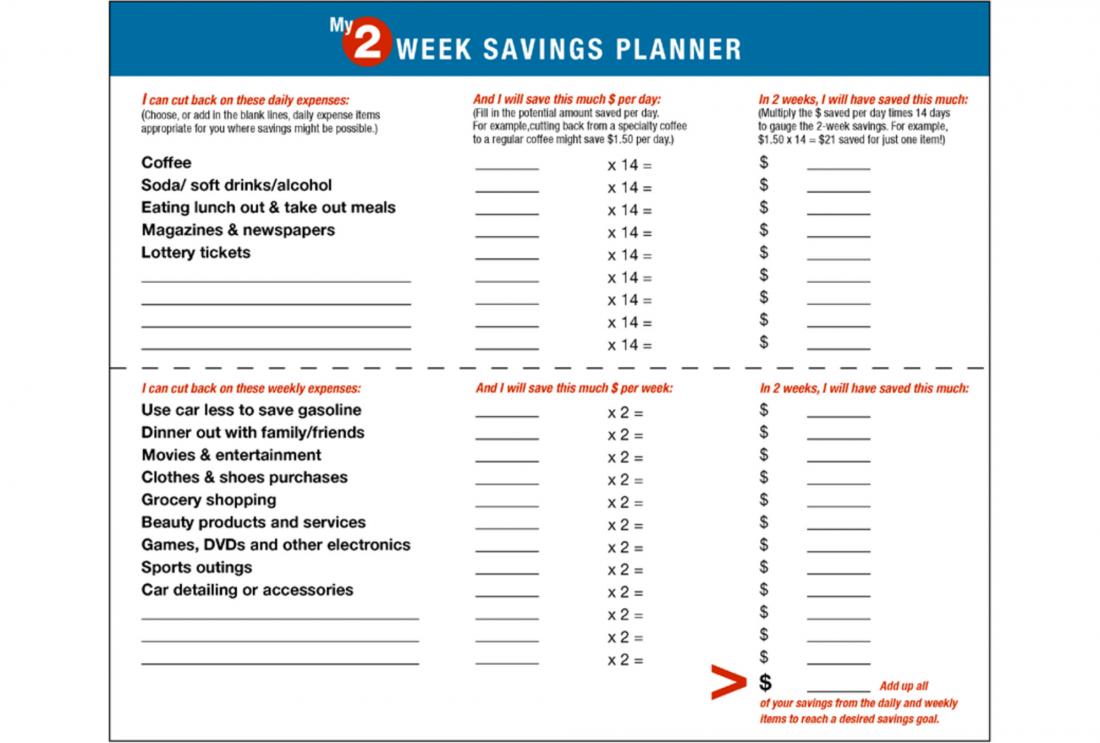

In addition, half of participants were randomly selected to receive a printed savings planner with tips on how to reduce expenditure.

After four months, researchers received participants' borrowing information from the payday lending chain, and were able to match the actual amount borrowed with the treatments received.

النتائج والدروس المستفادة بشأن السياسات

Impact on borrowing frequency: Adding up the dollar costs of loans had the greatest impact on borrowing frequency. Participants in the dollar information treatment group were 5.9 percentage points less likely to borrow in the pay cycles following intervention - an 11 percent decline relative to the comparison group. APR and refinancing information had a similar, although less robust, impact. The savings planner did not impact borrowing behavior or reinforce the effectiveness of information disclosure.

Impact on borrowing amount: Individuals who received any of the three information treatments reduced borrowing amounts. Specifically, the dollar, APR, and refinancing information treatments reduced borrowing by $55, $38, and $28, respectively, in each pay cycle (representing declines of 23 percent, 16 percent, and 12 percent relative to the comparison group).

The results suggest that financial literacy may substantially impact individuals' decisions as to whether to take out a payday loan. Getting consumers to think more broadly about the decision to take up a payday loan by stressing how the fees accompanying a given loan add up over time, by presenting comparative cost information to increase evaluation, or to a lesser degree, by disclosing information on the typical repayment profile of payday borrowers may result in a reduction in the amount of payday borrowing.