Overcoming barriers to women’s adoption of digital financial services in Indonesia

[Read this blog post in Bahasa Indonesia.]

As digital financial services (DFS) become increasingly commonplace, it is essential to ensure women and men are equally able to benefit from these technologies. Unequal access and adoption of DFS along gender lines could exclude women from tools for financial well-being, such as faster payments, more secure savings, and greater financial privacy.

In Indonesia, various efforts, such as digital financial education programs, expansion of QR code utilization to different types of merchants, and onboarding women-owned businesses to e-commerce platforms, have been and continue to be implemented to increase women’s DFS adoption. However, as challenges remain, policymakers should expand their approaches to further encourage DFS adoption in a gender-inclusive manner.

Digital readiness, defined here as owning a smartphone and being able to surf the internet or download an application, is a key enabling factor for DFS adoption. Gender-specific barriers to digital readiness and DFS adoption vary in their nature and severity across life stages.

To better understand this, J-PAL Southeast Asia’s Inclusive Financial Innovation Initiative (IFII) analyzed Indonesia’s 2020 Financial Inclusion Insights (FII) surveys to take a deeper look at gender gaps in DFS adoption and digital readiness. We analyzed gender gaps across three age groups: youth (15-29), adults (30-50), and older adults (above 50), which represent roughly 25 percent, 29 percent, and 20 percent of Indonesia’s population, respectively.

This blog summarizes our learnings from the survey about how gender and age interact, while highlighting opportunities for further research.

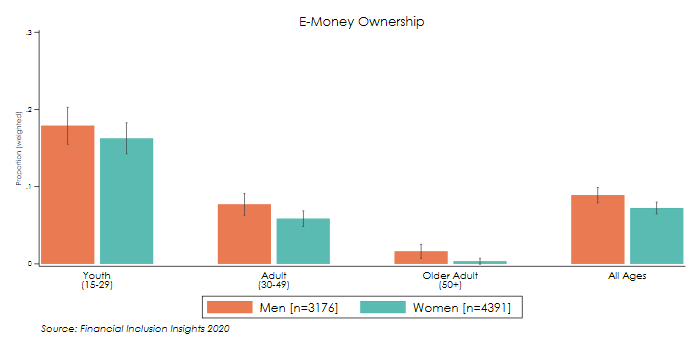

A digital divide in DFS adoption in Indonesia exists between younger and older generations, with women lagging behind in all life stages

In 2020, younger generations were significantly more likely to own a server-based e-money account than their older counterparts. This divide between generations for e-money ownership reaches as wide as 17 percentage points (pp) among men and 15pp among women. We also observe a gender gap, where e-money ownership rates are lower among women than men across all life stages (gaps of 1.6pp among youth, 1.9pp among adults, and 1.3pp among older adults)

This is partly a reflection of age and gender gaps in digital readiness. In 2020, roughly 57 percent and 48 percent of men and women respectively were digitally ready, and the younger age groups are significantly more likely to be digitally ready. Importantly, women are less likely than men to be digitally ready across all life stages (a gap of 5.3pp at youth, 9pp at prime age and 6.8pp at senior age).

This contrasts with Indonesia’s gender gaps in use of traditional financial services, such as bank accounts, where age and gender gaps are less apparent.

While there is still much room to improve the rate of bank account ownership in Indonesia, many older individuals do have an account (36 percent for older men and 31 percent for older women). In addition, young women (44 percent) are slightly more likely than young men (42 percent) to own a bank account. Despite this, young women are behind in terms of both digital readiness and e-money ownership. Boosting the use of DFS, such as e-money, will require investing in the building blocks of digital readiness.

Building blocks for digital readiness across life stages is needed to reach inclusive DFS adoption

Given the existing gender gaps, identifying suitable approaches to encourage DFS adoption among women at each life stage is a priority. Based on our observations above, there are two main policy implications to be considered:

- Women need additional support across the life course to be able to take advantage of emerging DFS. Young women, particularly those who already have a smartphone and a bank account, may be especially predisposed to adopt DFS.

- Ensuring meaningful take-up, especially at older ages, will require investing in digital literacy and more basic financial inclusion.

IFII supports the government, private actors, and nonprofits in their efforts to advance financial inclusion in Indonesia through the implementation of rigorous research, evidence sharing, and capacity building. To learn more about IFII, visit our RFP page or contact us.

[Read this blog post in Bahasa Indonesia.]