Improving women’s digital literacy as an avenue for financial inclusion

Indonesia is a standout country in terms of gender-equitable financial inclusion. Reports from the Global Findex and SNKI Financial Inclusion Insights state that although there is an average gender gap in account ownership of 8 percentage points in developing economies, no such gap exists in Indonesia. At the same time, there is still a large scope for overall expansion, as over 44 percent of Indonesian adults remain unbanked. To ensure Indonesia continues to experience gender-equitable growth, efforts geared towards financial inclusion must take into consideration women’s needs, in particular among poor and digitally illiterate populations.

On June 9, 2020, the Government of Indonesia (GoI) launched the National Women’s Financial Inclusion Strategy (SNKI-P), aimed at promoting access to finance for Indonesian women in a way that accommodates women’s diverse needs, interests, and backgrounds. Among others, SNKI-P’s mission is to provide a comprehensive and gender-responsive program to improve access to formal financial services, while ensuring all Indonesian women are equipped with financial skills (including digital finance). How can insights from Indonesia’s past financial inclusion experiences inform policies to support this mission? In this blog post, we summarize some key lessons from J-PAL SEA research conducted as part of its Inclusive Financial Innovation Initiative.

Understanding determinants of women’s financial inclusion

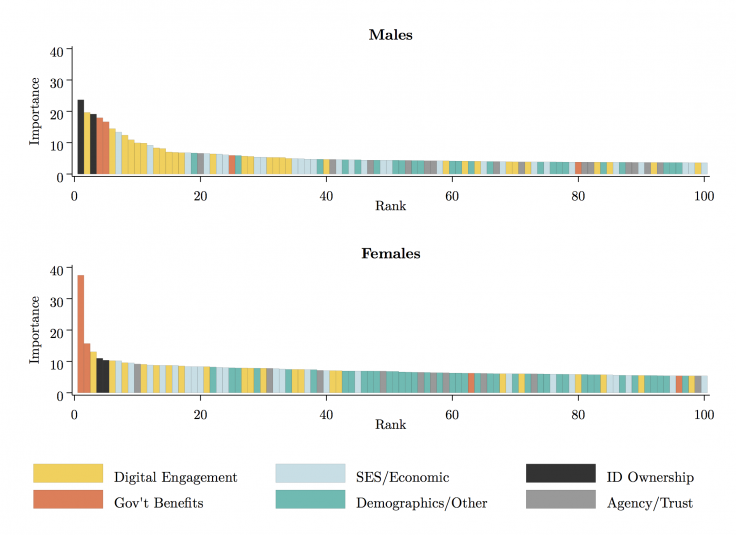

Social protection is important for women’s access to financial services, and digital readiness is likely to become more important as digital finance grows. As Indonesia moves to expand financial inclusion, it is important to understand why people do or do not own accounts. We utilized data from the 2018 Financial Inclusion Insights survey (FII) with a machine learning algorithm called Random Forest to identify key predictors of account ownership.

We find that features related to demographics, socioeconomic status, and economic engagement rarely rank highly as predictors. Gender was also not one of the top predictors of account ownership. Instead, the top predictor of female account ownership is whether the woman receives government assistance: specifically, women who report receiving government assistance are more likely to have an account, all else equal. This suggests that the Government of Indonesia’s push to digitize assistance is a driving force in women’s financial inclusion.

We also find that owning a mobile or smartphone and the ability to perform phone-related tasks are important predictors of account ownership for both men and women. In the future, digital engagement and digital literacy are likely going to become even more important for financial inclusion.

Source: FII 2018 Survey

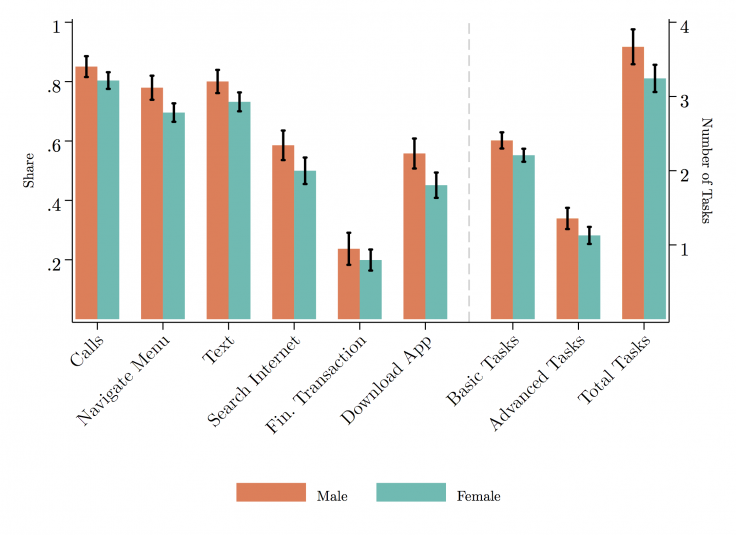

Indonesia has a gender gap in digital readiness, which if not addressed may lead to future gender gaps in financial inclusion. As digital financial services (DFS) continue to expand in Indonesia, digital engagement and literacy will be key for connecting women to new technologies like e-money. However, we see a significant gender gap in phone capability between men and women. While 45 percent of men are digitally ready—that is, own a smartphone and can use it to download apps and surf the web—only 38 percent of women are.

Source: FII 2018 Survey

Inclusive digital financial products must take account of women's life stages and needs

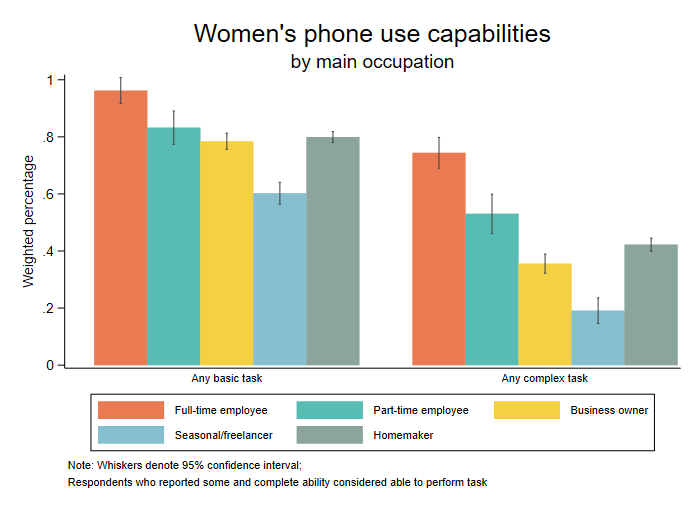

Use cases of DFS will be different for women who are running the household, leading their own business, or working for a firm. How included are these groups now, and prepared are they to take up digital tools?

The use rate of financial services is significantly lower among women not engaged in income-generating activities. Our analysis of FII data indicates that married women are more likely to report having a dominant role in financial decisions, as compared to married men. This is in line with previous research suggesting Indonesian women have authority over household finances, regardless of their contribution to the household’s income. Despite this, married women whose main occupation is taking care of the home or who only work temporarily/seasonally are significantly less likely to use financial services as compared to those who own a business or are in permanent employment. As such, there is still scope for expansion to ensure financial inclusion covers women who do not engage in income-generating activities.

Targeted digital financial education may be needed to ensure financial inclusion for all women. We observe a lower rate of digital literacy among business owners. Relative to business owners, women who are in full-time employment are 18 percentage points more likely to report the ability to perform basic tasks (i.e. place calls, navigate menu, send SMS). This gap is even larger at 38 percentage points for complex tasks (i.e. search internet, download apps, financial transactions). This discrepancy is likely to affect knowledge and use of DFS, especially with newer innovations such as card-based and app-based e-money products. One way to address this capability gap would be digital financial education and opportunities to build smartphone skills targeted to female entrepreneurs.

Source: 2018 FII survey

Efforts by the Government of Indonesia to drive financial inclusion for women, such as through government assistance, have resulted in significant achievements. As DFS continues to expand, digital engagement and literacy is only going to become more important. To ensure Indonesia experiences continued expansion in financial inclusion for women, significant gender gaps in phone capability must be addressed. DFS innovations which contribute to financial inclusion will also take into account women’s life stages and needs, including female entrepreneurs and those not engaged in income-generating activities.

This blog post is based on efforts funded by the Bill & Melinda Gates Foundation. The findings and conclusions within are those of the authors and do not necessarily reflect positions or policies of the Bill & Melinda Gates Foundation. The mission of IFII is to ensure that digital financial services can drive economic development while lifting up women, low-income groups, and marginalized communities.

For more information about IFII, contact [email protected].