Alumni Voices: Tracking COVID-19 and the digital economy at the Bank of Canada

In this post, Alejandra Bellatin (former Policy Intern, J-PAL LAC ’18) discusses her work at the Bank of Canada gathering high frequency indicators for the economic impact of COVID-19 and her new research regarding the impact of digitalization on the labor market.

Starting in March, COVID-19 and the related lockdowns led to an unprecedented deterioration of economic activity in Canada. As a member of the Digital Economy team in the Bank of Canada (BoC), I felt overwhelmed at the beginning of the crisis. My team at the BoC was tasked with finding and analyzing high frequency indicators that could help us better track the evolution of economic conditions amidst the pandemic. To grasp the magnitude of the decline and the potential channels for the subsequent recovery, we needed additional, timely, and disaggregated information to supplement official statistics, which often came with lags. My co-workers and I put together an interactive dashboard with over forty data sources.

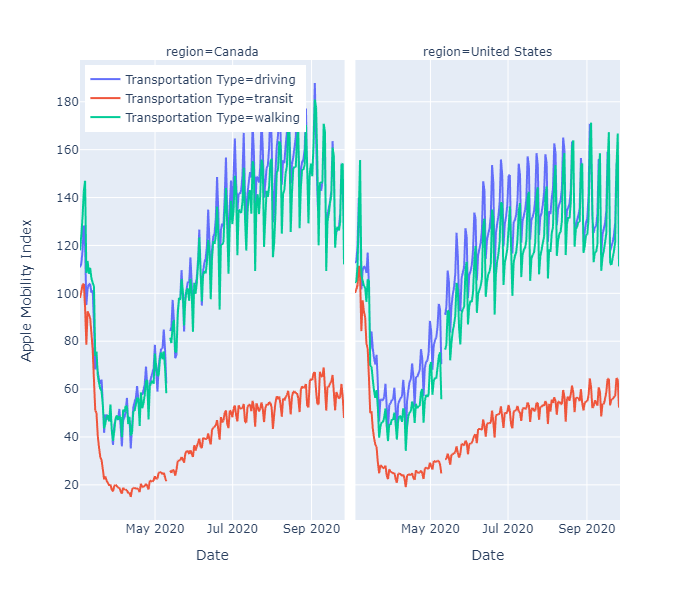

Source: Apple mobility data

Being a part of this project gave me the opportunity to know the ins and outs of what was happening with the economy in real time. It was fascinating reading the news and seeing in the data the impact of every reopening announced across provinces. How often were people in Vancouver going to parks? Had all transactions gone online? Were companies even hiring? Only a couple of days lagged, we could see the different trends across provinces and industries and relay this information to policymakers through our dashboards and concise data briefs. Being involved in these dashboards also allowed me to talk to people across the BoC, from the payment specialists to the nowcasters.

COVID-19 has also inspired lots of analysis at the BoC, ranging from the shape of the recovery to unconventional monetary policy. The question that draws me the most is what the labor market will look like after the pandemic. According to Canada’s Labour Force Survey, between February and April the number of unemployed people in Canada more than doubled. As the economy reopens, the number of jobs is increasing once again. However, the recovery could differ across occupation groups.

For many years, economists have talked about the polarization of labor: the trend that middle skill employment is decreasing. As a result of digitalization, routine manual jobs are being automated and there has been an increase in non-routine creative jobs. Many of us are wondering what the new normal is going to look like after spending all this time working remotely. Is the pandemic accelerating this digital shift that we’ve been hearing about for years?

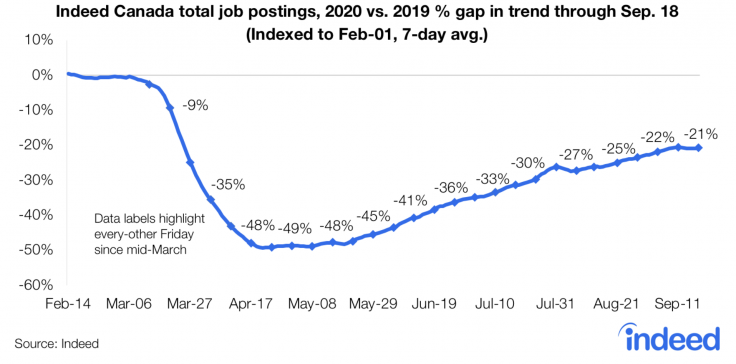

A good way to have a little peek at the future of work is analyzing job posting data. Job postings display the skills that employers are looking for right now. Hiring behavior shows labor demand and serves as an early flag of occupational shifts in job creation.

Source: Indeed Hiring Lab

While some employers have faced temporary downsizing, others might face permanent restructuring, or expansions. COVID-19 might be accelerating a shift to the digital economy through e-learning, virtual meetings, and automation of certain processes as required by the social (physical) distance.

Alongside Gabriela Galassi, I am studying the long-lasting effects of the COVID-19 pandemic on the Canadian labor market, focusing on job creation and destruction. Our work is still preliminary, but we hypothesize that we will find an increase in the proportion of job postings for occupations that can be done from home in the short-term and are non-routine in the long-term.

As certain jobs are being destroyed, workers are going to need to be retrained and repurposed. Moreover, potentially the skills demanded under the new-normal are going to be driving trends in education and accreditation. While it is difficult to predict how the labor market will look like after the pandemic, at the BoC high frequency and non-conventional indicators have helped us face this policy challenge. Going forward in my career, a big lesson I’m taking from this experience is how you really need data about the right now to make decisions about the future.