The Impact of Offering Pay-as-you-go Car Insurance on Covering Drivers in California

- Adults

- Market access

- Consumption smoothing

- Insurance

Nearly seventeen percent of drivers in California are uninsured, exposing themselves to large financial risks and increasing costs for other drivers. Researchers conducted a randomized evaluation to test the impact of introducing a pay-as-you-go car insurance contract, which reduces minimum purchase requirements, to uninsured drivers in California. Applicants who were offered this type of insurance were nearly twice as likely to purchase car insurance than those who were offered a traditional car insurance contract, but this impact faded over time. While pay-as-you-go contracts can increase demand for insurance by reducing upfront costs, more research is needed to understand how to persistently increase insurance coverage.

Policy issue

Despite legal requirements that all drivers must have car insurance, millions in the United States drive uninsured. Driving without insurance exposes the driver to large financial risks and increases insurance premiums for other drivers.

Typically, car insurance contracts cover a driver for a term of six or twelve months and require the customer to pay the cost of insurance, or “premium,” upfront or in monthly payments. Minimum-liability insurance is car insurance that fulfills a state’s insurance requirements, and is thereby the least expensive insurance an individual can purchase. This type of insurance only covers damages or injury caused by the insurance holder and does not cover damage or injury to the insurance holder themselves. Households with limited access to savings or credit may be unable to afford insurance because of the high upfront costs. They may also have limited assets to protect in the event of an accident which could limit their demand for coverage.

In addition, because of the high cost of monitoring, typical car insurance contracts may overcharge drivers who drive less than average. Low-income drivers drive fewer miles on average, lowering the risk of an accident. As with many insurance markets, car insurance companies depend on the payments of lower-risk drivers to cover the cost of claims when an accident does occur. Therefore, low-income drivers also essentially pay for some of the cost of high-income drivers’ claims, which can be viewed as inequitable.

Pay-as-you-go contracts offer a promising solution to making insurance markets more accessible and have been used in other settings, such as cell phone and utility contracts. Pay-as-you-go contracts do not require a large payment at the beginning of service, but rather allow the user to buy the service in small increments. This model of a car insurance contract allows drivers to buy insurance in small amounts, avoiding high upfront costs and paying for days without driving. Offering pay-as-you-go car insurance may cover more drivers than only offering traditional car insurance contracts.

Context of the evaluation

In the United States, 12.6 percent of drivers drive without the legally required car insurance. In California, this number is even higher, at 16.6 percent.

California has implemented many policies to reduce the share of uninsured drivers, such as steep fines, vehicle impoundment, and barring uninsured drivers from collecting compensation from an accident in which they are not at fault. The state also offers the Low Cost Auto Insurance program, which reduces the minimum insurance requirements and costs for low-income drivers with a “good” driving record.

However, pay-as-you-go contracts had previously never been offered in California as a solution to uninsured driving. Hugo Insurance Services was the first provider to offer this type of contract in the state. Their pay-as-you-go auto insurance allows drivers to purchase insurance in small quantities of three, seven, fourteen, or thirty days and only pay for the days they drive by turning the insurance “on” or “off” by text. Hugo Insurance Services first introduced this insurance model with the goal of offering a contract that would be affordable for low-income, uninsured drivers.

Details of the intervention

Researchers conducted a randomized evaluation to test the impact of offering pay-as-you-go contracts on insurance enrollment. Drivers were directed to the Hugo Insurance website through internet advertising and invited to apply for a quote. A driver was eligible to receive a quote if they were over 18 years old, had a valid license, and met other minimum criteria. Applicants were accepted between March 8, 2019 and August 30, 2019.

The study consisted of 1,537 people who were mostly low-income young adults with low credit scores: the median income was $34,000, the median credit score was 532. Researchers tracked whether applicants bought insurance and how often the insurance was active for three months after enrollment.

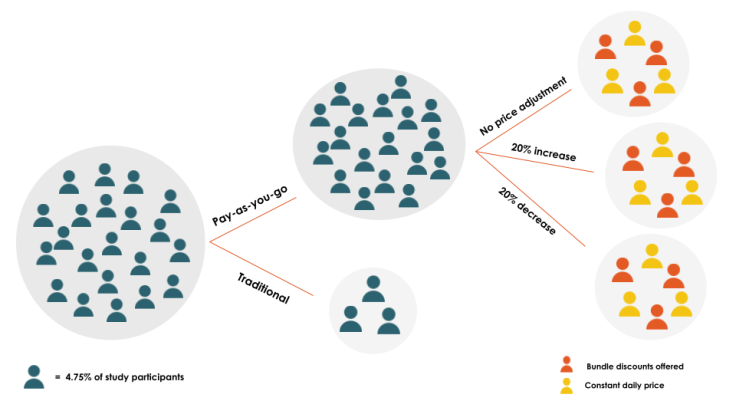

The price of insurance was calculated based on individual risk factors, such as age and accident record. One-seventh of the applicants were randomly assigned to the comparison group and were offered a traditional three-month minimum-liability-insurance contract with payment of three months of coverage due at the time of enrollment.

The other applicants were randomly assigned to the intervention group and offered a pay-as-you-go contract. In addition, applicants in the intervention group were randomly assigned to one of three pricing options: no adjustment to the price, a 20 percent increase in price, or a 20 percent decrease in price. Half of each group was randomly offered a discount if a larger “bundle” of insured days were bought at once, while the other half received a constant daily rate.

By comparing the intervention and comparison groups over three months, researchers were able to measure initial enrollment in car insurance and usage over three months. The variation in pricing in the intervention group measured whether changes in price impacted the likelihood of purchasing insurance. Additionally, they were able to evaluate how often participants were willing to give up a discount and instead get a smaller quantity of insurance at a higher price.

Ethical considerations:

All participants who enrolled in an insurance plan through the study were covered by an insurance policy purchased on their behalf, which insured their driving even when their pay-as-you-go insurance was inactive, for the duration of the experiment in order to guarantee that no participants would be adversely impacted by their participation in the study.

Results and policy lessons

Offering pay-as-you-go insurance coverage to applicants increased both the likelihood of buying car insurance and the number of days with coverage in the following three months. However, there was no measurable impact on being insured at the end of the study.

Take-up of car insurance: Applicants offered the pay-as-you-go car insurance were 10.8 percentage points (89 percent increase from a baseline of 12.1 percent) more likely to buy car insurance than those who were offered a traditional contract from Hugo Insurance. This may be because the smaller minimum payments made car insurance more accessible to those who could not pay the higher up-front cost of a traditional contract. This model allowed drivers to pay for car insurance in smaller quantities at a time when assets were not a constraint. There is some suggestive evidence that drivers without prior coverage history may be more likely to buy pay-as-you-go car insurance.

Number of days of coverage: Applicants offered the pay-as-you-go plan had 4.6 more days with coverage available (27 percent increase from a baseline of 17.3 days) in the three months after the account creation date. The smaller effect could be due to the relatively high cost of this rollout of Hugo’s insurance, or the cost and effort required of the driver to text to pause and start coverage again. Since the study, Hugo changed the pricing scheme of the pay-as-you-go insurance to be more affordable, which may further increase and maintain insurance rates.

Insured at the end of three months: There was no measurable difference in being insured at the end of the study between the two groups. This may be due to drivers switching to another insurance carrier. More evidence is needed to understand why insurance rates do not increase in the long term.

This evaluation demonstrates that traditional insurance contracts aren’t meeting the needs of all drivers and there is a demand for car insurance that is offered in smaller quantities with lower upfront costs.

Use of Results:

Hugo Insurance Services used the results of the evaluation to inform the pricing and structure of the pay-as-you-go contract in order to best serve their customers. They also used the results in regulatory conversations in order to expand their pay-as-you-go insurance offerings in California and Illinois.