Delivering Conditional Cash Transfers Through Checking and Savings Accounts in Chile

Many beneficiaries of social welfare programs around the world receive benefits in cash or by check. Can distributing welfare benefits through electronic transfers directly into bank accounts help some of these low-income individuals enter the formal financial sector? Researchers are partnering with the Chilean government to evaluate how transitioning a social welfare program from cash distribution to electronic transfers impacts recipients’ access to their funds, as well as their savings and consumption decisions.

Policy issue

Bank accounts can provide a safe and secure way for low-income households to build their assets to make large, lump-sum investments or protect against unforeseen expenses. Yet many poor households don’t use formal financial services. In Chile, for example, over 60 percent of adults had a savings account in 2014, but just 15 percent of adults saved in formal accounts.1 Increasingly, governments and financial service providers are looking to better integrate formal financial products into the daily lives of the poor in order to drive usage. One approach is to directly deposit social welfare benefits or wage payments into bank accounts rather than sending cash or checks. These payments may increase poor households’ interaction and comfortability with formal banking while reducing costs and increasing efficiency of the payments. However, the ability of electronic payments to integrate underbanked households into the formal financial system has yet to be studied in detail.

Context of the evaluation

The Government of Chile operates a social welfare program called “Puente,” which provides monthly financial support to more than 300,000 poor families. 99 percent of these payments are made in cash. In order to improve efficiency, reduce costs, and connect recipients with formal banking services, the Chilean government is rolling out a program to directly deposit these payments into recipients’ bank accounts.

Details of the intervention

Researchers are conducting a randomized evaluation to measure how the Chilean government’s transition from cash distribution to electronic transfers affects recipients’ access to funds, as well as their savings and consumption decisions.

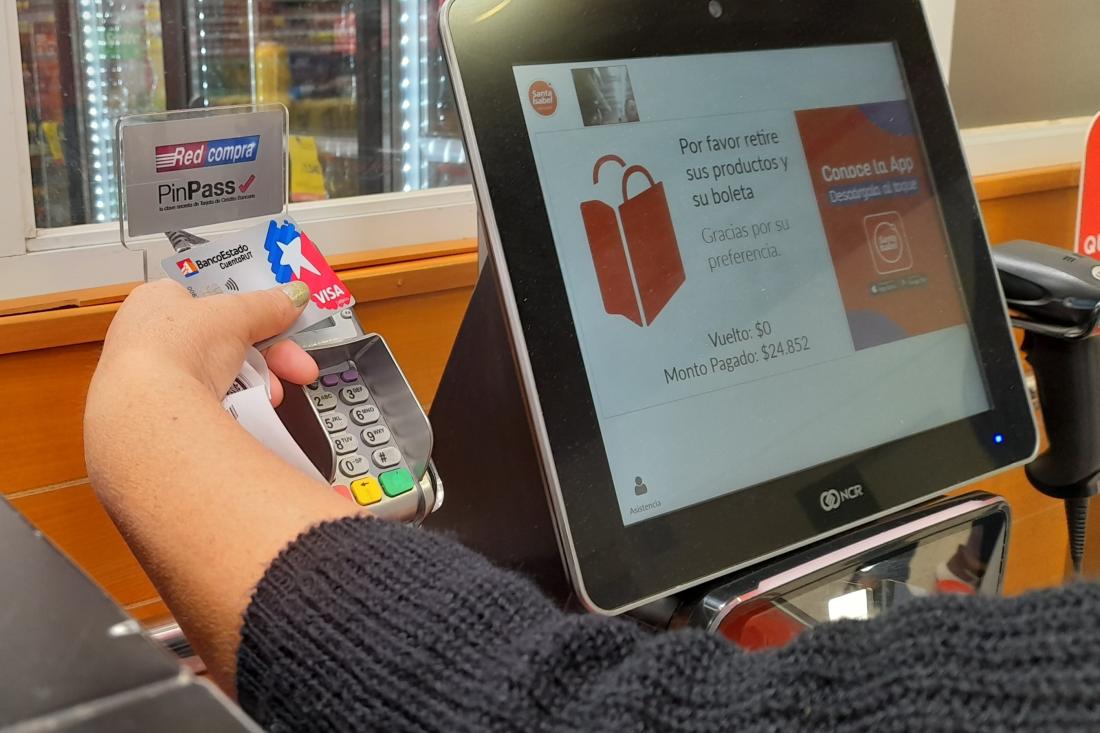

The Chilean Ministry of Social Development, which runs the Puente social welfare program, is working with Banco del Estado, a state-owned but independently run bank, to electronically deposit social welfare payments into beneficiaries’ bank accounts. As the program rolled out, researchers randomly selected 3,232 Puente beneficiaries in and around Santiago to participate in the study. Three quartersof these beneficiaries were randomly selected to receive an offer for a bank account and direct deposit of their welfare payments into the account. The remaining beneficiaries continued to receive their payments by check, serving as a comparison group.

The researchers are using in-person surveys and administrative data from Banco del Estado on participants’ account balances and transaction records to measure how the automatic transfers affect how beneficiaries use their accounts over time, as well as their spending decisions, employment outcomes, empowerment within their households, and self-esteem.

Results and policy lessons

Results forthcoming.

Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, and Peter Van Oudheusden. 2015. “The Global Findex Database 2014: Measuring Financial Inclusion around the World.”