Surveyor hiring and training

Summary

This resource focuses on in-house data collection. Information about outsourcing to survey firms is available in the resource on working with third party firms.

Running a large-scale household survey may seem like a daunting task at first, but don’t despair. The trick is to develop a detailed plan at the outset of the project and tackle it one step at a time. Below are five major steps to managing a large-scale survey project:

- Prepare and finalize survey instrument

- Institutional approvals. These include approvals from IRBs, government officials, or any other institution, depending on the nature of the project.

- Recruit field team

- Train field team

- Survey launch!

This section will detail steps 3 and 4.

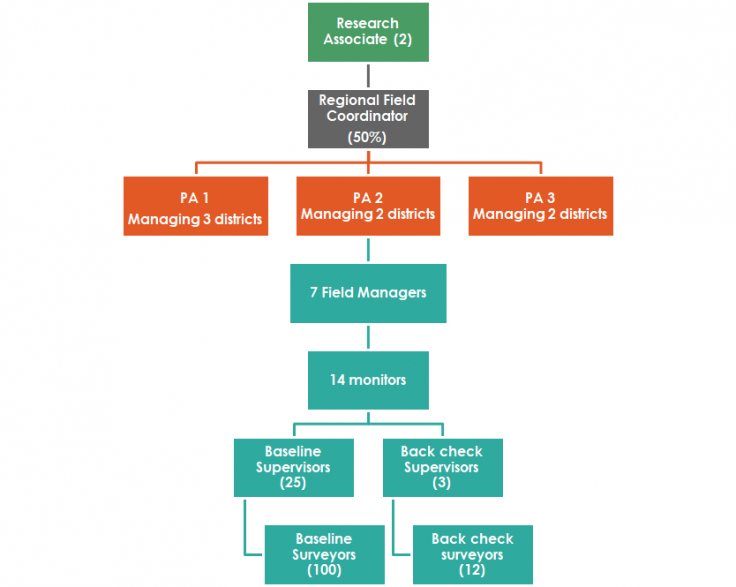

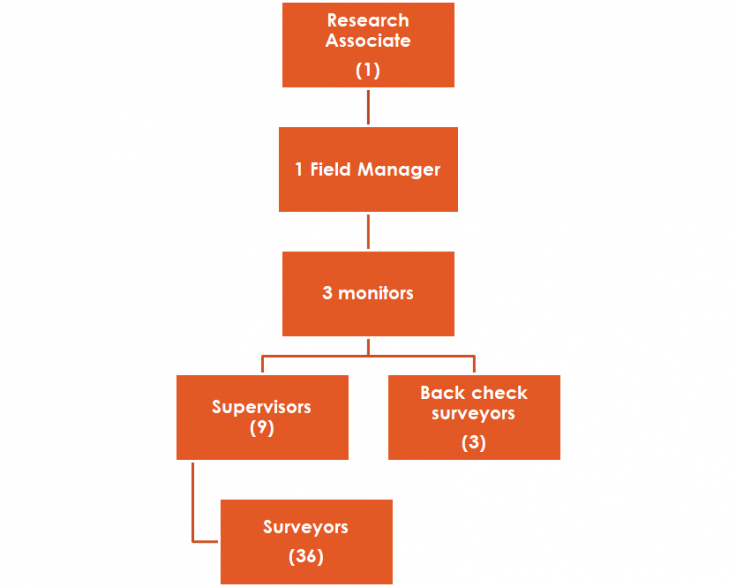

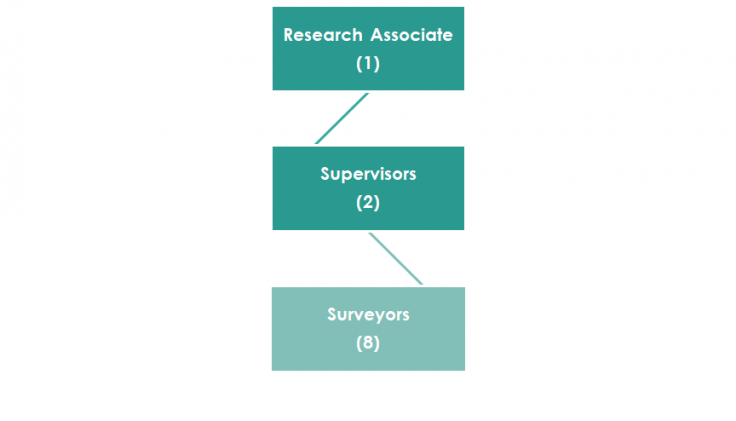

The field team

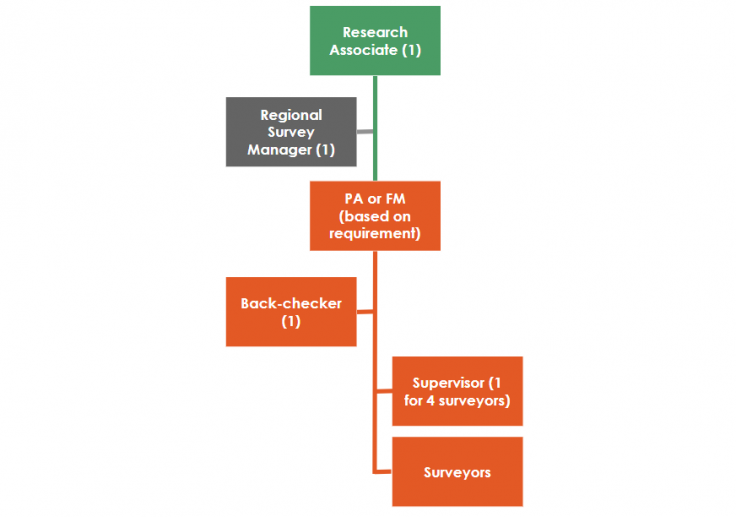

The field team can consist of multiple roles--surveyors, supervisors, field monitors, field managers, and project assistants. Additionally, overseeing the field team are the principal investigators (PIs), research manager (RM), and research assistant (RA), who may not go into the field but will supervise field operations through data quality checks and implementation monitoring. There are many different structures that can work, depending on the project’s complexity and scale of data collection. A brief description of each position is below, followed by sample structures, depending on the field team size.

- Project associates (PAs) report directly to the research associate and are responsible for overseeing data collection activities. They are in charge of managing all the members of the field team. They are also responsible for reporting the progress of data collection to the RA, maintaining attendance logs of the field team, and creating weekly plans for the data collection. They also lead debrief sessions with the full team.

- Field managers are responsible for the day-to-day logistics and implementation of the data collection activity in accordance with field and survey protocols. They address any adverse issues that arise in the field. They also supervise field monitors. They are typically needed in large-scale projects which are spread across multiple locations.

- Field monitors have the sole responsibility of monitoring the quality of the survey or the intervention implementation. They conduct regular data quality checks such as accompanying surveyors, and random back checks. They report their findings to the project associate or research associate for appropriate action. Such action is typically refresher training for the surveyors.

- Supervisors are responsible for supervising a survey unit of 2-4 surveyors, assigning respondents to surveyors, and keeping track of the progress of the data collection activity.

- Surveyors (enumerators) are responsible for administering the survey to the respondent as per field and survey protocols.

Below are some examples of field team structures. Remember that all the choices that you make regarding the number of staff, types of positions, organization of the team, etc. have implications for the project timeline and budget, as well as quality of data collected.

If in-person surveys and monitoring are not possible, field team structures will require some adjustments. A field manager or monitor may not be needed, but in the absence of in-person supervision, projects may instead need to budget for more staff to help with monitoring, especially if surveyors will be working from home. More details on this can be found in J-PAL South Asia’s budgeting guide for phone surveys with remote monitoring. An example team structure for remote surveying is below.

Recruiting the field team

There are usually several stages in field team recruitment. A good starting point is to work out how many candidates you need to secure for each stage by working backwards from the target number of surveyors. Define the end target field team size using the sample size together with conservative assumptions of how many surveys can be completed per day in the study and context (accounting for transport costs, unanticipated challenges, respondent unavailability and slowdowns towards the end of the survey). If you anticipate a high rate of dropouts, aim to invite an additional 20% of prospective surveyors to training, so that training can be used to select the best surveyors for the project. Also bear in mind that you will need to interview many more candidates than will ultimately attend your training.

Hiring sources

The common channels of surveyor recruitment are:

- Existing database: If the data collection is planned for a region where J-PAL, Innovations for Poverty Action (IPA), or your organization has worked before, there will likely exist a central repository of field staff that have worked with the organization before, and/or are currently working. Apart from typical information such as educational qualifications and prior work experience, staff members can also be tagged by past performance, language skills, ability to conduct specialized surveys, and other relevant information. If such a database does not exist, consider recording these details about your field staff and sharing them within your office.

- Visiting local colleges: The RA can visit local colleges at the field location, or at sites close to the field location to recruit surveyors. They can meet with the administrators of colleges to advertise the position, and also organize sessions to advertise it. Additionally, the RA can also hand out pamphlets and put up posters, particularly if in-person sessions cannot be arranged.

- Job advertisements in local newspapers: The advertisement should provide important details for job seekers: a brief job description, salary range, location of the job, contact information, and selection process. Special requirements such as travel to remote locations, staying overnight in the field location, working unusual hours, or required driving skills should especially be highlighted in the advertisement.

- Job advertisements on online job boards, with the same guidelines as local newspaper adverts. An online advert can also include a link to a short application form (e.g. Google Form) asking specific questions that are important for the project, e.g. languages spoken, availability to survey on weekends. This has the benefit of testing a core required skill (data entry) as well as producing a list of candidates in a format that is easier to navigate than many resumes.

- Implementing partner: The implementing partner may also have recommendations for field staff, or can advertise the position in their network.

- Other projects: It is also a good idea to get recommendations for staff from other projects in the region (if applicable). For short-term requirements such as scoping or piloting, it is also possible that some of their current staff may have some downtime and may be able to work on your project for a short duration.

- Data collection agencies: Note that there can be different hiring institutions, e.g., the host institution of a J-PAL office, an IPA office, or a local partner. It is important to be aware of legal constraints in the country in which the project takes place and to be aware of the procedures of the hiring institution, which can take time and must be kept in mind when planning the data collection activity. You may also need to use more than one hiring source, so be sure to bear in mind the time taken for recruitment of each source, and plan accordingly.

Screening

Once you have a pool of interested enumerators, you need to screen out unqualified enumerators. You may need to distinguish the screening process based on the candidate type. Candidates with prior J-PAL/IPA experience will have most likely met several requirements, in which case you may need to only screen on the basis of their past performance and conduct. For candidates with no prior experience, or some experience but not with J-PAL/IPA, it is important to do an in-depth screening. In order to do so, you can either solicit resumes/CVs or have enumerators fill out an application which includes the following:

- Highest degree completed

- Prior work experience

- Languages spoken: English is important as it is often the language the trainings are conducted in. Additionally, it is very important that surveyors are able to read, write, and speak the survey language. While this usually refers to the primary local language, sometimes it might also be helpful to screen for other languages, if there is a possibility that the primary language will not be spoken/used by respondents in specific locations.

- Software skills (e.g., Microsoft Word or Excel, etc.): these are more important for senior positions as they will need them for filling out tracking sheets, filing attendance and payments for team members, and so on.

- Experience with electronic devices (e.g., touch screens and electronic data entry, etc.): this is important for field surveyors and back checkers.

- References from previous jobs

- If required by the hiring institution, valid bank accounts, tax identification numbers, or other administrative requirements.

- Fit with project requirements (e.g., if study sample is teenage girls, you may need to hire only female enumerators, or if the study sample is spread out, you may need to hire only enumerators who have motorbikes, etc.)

After screening resumes/applications, conduct interviews and practical tests for shortlisted candidates. Interviews are useful to verify the information listed on their resume (e.g., language skills) as well as testing for the below characteristics.

- Basic mathematics skills: This can be important if surveyors need to do a unit conversion (e.g., the answer provided by a respondent (on spending, income, etc.) does not fit the period stated in the question, or if they have to pick a midpoint of a range, etc.). Assessing math skills explicitly can be necessary if your region is known to have poor numeracy levels.

- Ability to communicate clearly and engage with the respondent (i.e., whether the candidate seems friendly and polite and whether he/she can easily establish a rapport with someone)

- Attention to detail/accuracy in data entry

- Familiarity with local context or culture

Note that language skills--both local language and English--as well as familiarity with the local context or culture, are especially important. These characteristics make it easier for the field staff to communicate with both the research team and respondents.

Interviewing

Candidates can be asked questions on their responses to various scenarios, depending on the position. These interviews can often be short, as training participation is often a better method for making a final selection. The purpose of an interview is to discern a pool of candidates who are suitable for training.

Interviews can include:

- General questions on previous experience, motivation for the job and availability

- Short tests, e.g. paper-based numeracy tests, reading aloud of 5-6 interview questions, response recording

- Scenario questions, designed to test a candidate’s instincts for dealing with field issues

Group interviews can be a time-efficient way to shortlist candidates for training, with the added benefit of revealing candidates’ confidence, interpersonal and communication skills. A group interview of 8-10 fieldworkers could take the following example form:

- Short personal introductions, with each candidate and the interviewer(s) providing 2-3 minutes of background on themselves and their prior experience

- Brief introduction to the organization, project, timeline and payment details

- Candidates are given a 5-minute paper-based math test

- Candidates take turns in reading aloud questions from a shortened version of the survey, to test reading fluency

- Two RAs role-play a survey providing some unclear and ambiguous responses to some questions while candidates record their answers on a paper-based version of the survey

- 5 minute one-on-one conversations with each candidate

Candidates can be asked questions on their responses to various scenarios, depending on the position.

- For senior positions such as project associates or field managers, you can ask about the scenarios listed below:

- Village leader does not allow you to survey in the village

- Fraud by surveyors

- Relationships between staff (e.g., friendship, favoritism, or romantic relationships, etc.)

- Violence in the field

- Former employee is disgruntled

- A village mob forms and threatens the surveyors

- Survey data is not being collected correctly: (i.e., protocols are not being followed)

- What do you do in the field?

- What do you do with the data collected already?

- For surveyor positions, you can ask them basic questions such as:

- How would they ensure that the respondent is interested in being a part of the study

- How would they establish trust so that the respondent is fine with the survey

- Additionally, you can ask both surveyors and supervisors their responses to the following situations:

- Part-way through a survey, realize that a respondent is unable to respond at this time (e.g., due to illness, family duties, intoxication, etc.)

- Respondent seems uncomfortable answering questions in front of other household members

After conducting interviews, you may either make final hiring decisions or invite shortlisted candidates to training, where you may want to assess their performance before hiring them (see Training section below). In either case, you will eventually need to provide the enumerators with contracts.

Additional considerations for hiring surveyors for remote surveys

Phone surveys require some additional technical and interpersonal skills. You may want to consider the following characteristics when screening and interviewing candidates. These have been adapted from Appendix A of J-PAL South Asia’s resource on Transitioning to CATI.

- Ability to navigate unexpected situations/questions during the survey. Since phone surveys require surveyors to ease the respondent into trusting the validity of the research purpose, organization, and questions, it is important that the surveyors are able to answer any potential questions from the respondent (or their family’s) side.

- Clarity of diction and voice and the ability to maintain a steady conversation for the duration of the survey.

- Familiarity/understanding with handling electronic applications independently. Remote surveys may require surveyors to record call attempts and subsequently upload recordings to a Dropbox/Google Drive; hence it’s important that they have a basic understanding of navigating these applications. Note that IRB approval is needed to record calls.

- The ability to build a rapport with the respondent and ease them into answering sensitive questions, particularly because questions are being asked over the phone.

- Ability to deal with distractions during the call.

Contracting

Depending on the local context and legislation, you may have different types of contracts--for example, one for the training period, and another for when the surveyors begin actual work. Important sections or clauses that should be covered by the contract are:

- Start and end dates of the contract, days and times of work (e.g., if weekend or evening work is expected)

- Location of the position

- Scope of work (i.e., a list of duties, milestones, and deadlines for the project)

- Payment information, including salary and benefits, daily stipends and other benefits and allowances, e.g. for evening and weekend work, travel reimbursement, performance-based pay components

- The notice period for termination of the contract

- Data confidentiality agreement

- Expected code of conduct

- Equipment use/treatment

- Incentives for high-quality work (e.g., low refusal or error rates), including promotion to supervisor, praise in front of the whole survey team, etc. Incentives are most effective if the survey staff both know and anticipate them.

Always refer to the Human Resources department of the contracting institution (e.g., your host university) before making any promises to your successful candidates, and contact your finance / admin team for assistance in preparing the contracts. Go over the contract in detail with staff to be sure they understand it. Don’t assume that they will understand the contract simply by reading it!

J-PAL staff and affiliates: See also the template device contract.

Data Confidentiality Agreement

The survey instrument will likely collect personally identifiable information and potentially sensitive information about respondents. Since the field team is responsible for collecting, storing, and transporting this data securely, it is vital to ensure that they understand the need for confidentiality of this information. They should also be instructed not to share information they learned from a person they interviewed with other people, such as other survey participants, local officials, or their own family or friends. Finally, they should also understand the risks to respondents if the respondents’ personal information is not kept confidential. While all of these aspects can be covered in detail during their training, it is recommended to include a data confidentiality agreement in staff’s work contracts. This may also be an IRB requirement.

Salary and Benefits

There are different payment structures. A common structure is a fixed salary plus benefits, which can include:

- Travel allowance. This can be a flat amount per day, or reimbursement of actual expenses. Additionally, if a vehicle owned by staff is used for traveling to the field, staff can reimburse these expenses--typically at a flat rate per kilometer.

- Per diem allowance. The project is required to have a base station. Typically, staff are asked to make their own arrangements to live at this location. However, during data collection, since field locations are spread out around the base location, staff will incur expenses on food and accommodation while in the field. This allowance is intended to assist them with these expenses.

- Mobile allowance. If communicating with each other or the RA is an important task for the field staff members, they can also be paid an allowance to cover their phone expenses.

Flexible salary components may include bonuses or performance pay (see above). More on field team payments can be found in the field team management resource.

Training

Training is essential for ensuring high-quality data and strict adherence to research protocols. Training can vary widely from country to country and study to study, depending on the complexity of the project, the survey instruments, and the research protocols. Preparing for a training session requires making decisions, especially on information to share with enumerators and how to train them on situations they may encounter in the field. For instance, in some cases, a few days of field practices are absolutely necessary to train the enumerators while they can be irrelevant or impossible in other cases.

Planning the training session

- Define the objectives. While the main objectives are usually to inform enumerators and train them on survey instruments and protocols, in some contexts, training can also be the last step of the recruitment process of enumerators. Training is a very good opportunity to assess them on characteristics such as punctuality, attention to detail, ability to learn quickly, communication skills, etc. Using this information for deciding on the final staffing and composition of teams is a highly recommended practice.

- Draft the training agenda. Drafting the training agenda will help you to define the duration of your training. The duration can vary from one day to two weeks. The key points to bear in mind while drafting the agenda are:

- Select the topics to be covered, including activities (refer to next section “Outline of Content” with all different elements of training)

- Define the number of hours per presentation / activities

- Checklist before training

- Prepare the budget, training agenda, and surveyor manual and review them with your PIs/Research Manager. The surveyor manual is a mandatory document. It describes all survey instruments and protocols and will be used during the training as well as a reminder for surveyors in the field. It is updated during training depending on enumerators' questions.

- Book a venue for training.

- Prepare paper and other materials for training.

- Invite participants. You should invite more participants than you need enumerators because you will likely experience dropouts through the duration of the training, or even in the first week of the survey (or you may use the training to select the final survey team).

- PIs should review the training agenda and draft of the surveyor manual before training begins.

Outline of training content

- Introduction to your organization (if applicable; optional depending on surveyors' experience working with your organization--around 1/2 hours.)

- Organizational policies (highly recommended--between 2-4 hours). This session should provide an overview of the organization (as relevant) and key persons in the organization and explain key policies such as safety and security in the field, data confidentiality, sexual harassment, child protection, and the organization’s code of conduct. You should also go over policies around payment (incl. overtime rates), expenses, and reimbursements. You can save this for later if you have not yet finalized your successful candidates.

- Project overview (highly recommended--duration depends on the complexity of the project and what information you want to share with field staff). This session should introduce the project and its objectives, the upcoming data collection phase, and an overview of the survey instrument. One important decision to make is whether or not to include a description of the study and information on the randomization protocol. Depending on the context, it can be necessary to explain the full study, different treatment arms and rationale to surveyors (for example, if surveyors are administering the treatments), but in general it is preferable for surveyors to be completely blind to treatment status and sometimes to not even know the full design, so that they do not disclose information about the study, or treat different treatment groups differently. These decisions should be made in collaboration with PIs.

- Team structure (highly recommended--around 2 hours). This session should explain the team structure, with emphasis on the reporting lines. Each team member’s roles and responsibilities should be clearly explained, as well as their expected conduct in the field and in the office.

- Research protocols (mandatory - duration depends on the complexity of protocols). This session should cover protocols to be implemented to ensure ethical conduct and data quality. It should cover the following points:

- How to interact with respondents: This can include sections on how to build a good rapport, how to survey in a neutral way, being patient with respondents, and any specific areas of sensitivity related to the given project.

- Importance of informed consent and other research ethics considerations

- Basic surveying protocols

- Explaining back checks and other quality control procedures (this has an incentive effect, as surveyors who know there will be back checks will be less tempted to rush). Note: do not inform surveyors when or which subjects will be checked.

- You may want to include an optional session on general conduct expected of surveyors.

- Survey instrument (mandatory--duration depends on the type of survey administration). Surveys can be auto-administered, i.e., by respondents themselves; or administered by surveyors. In both types of surveys, respondents are likely to have questions about the survey (before or during the survey). It is also important to train surveyors on how to answer those questions.

- Auto-administered surveys: For these, you might not want to review each section of the survey instrument in detail with enumerators, in particular if the survey is very long. In this case, it may be sufficient to give enumerators a good overview of the different sections of the questionnaire and make sure they know how to use the device and debug it. However, surveyors may need to be able to answer questions about unclear survey questions and need information to what degree they are allowed to assist the participant.

- Surveys to be administered by surveyors: Multiple sessions might be necessary to go through the survey instrument in detail. Each session should be devoted to a module of the instrument that explains the questions, answer choices, skip logics, definitions of terms, and special instructions for questions, if any. It’s a good practice to first review the instrument on paper before the digital version. It is also highly recommended to include sessions for role play and mock practice to ensure that trainees have a thorough understanding of the process.

- Role play: Once the group has been trained thoroughly on the survey instrument, divide them into pairs to practice the survey as surveyor-respondent. The role play or mock interviews should be done in changing pairs, until each person has a solid understanding of the survey and administers it correctly. It’s a good idea to encourage the person playing the respondent to think of a few difficult responses, e.g. ones that are ambiguous/difficult to categorize. They may also think up questions for the surveyor on why they are asking a certain question.

- Group role play: An effective way to learn about the survey as a team can be to sit as a larger group in a circle and let the first person practice three questions out loud with their left neighbor, then the first respondent surveys their next neighbor, and so on. At each step, the group can discuss the survey questions together; e.g. others can comment on the way the question was administered, ask clarifying questions, or give interviewing tips.

- Translation (optional--3-4 hours or as needed). If surveys are to be conducted in multiple languages by multi-lingual surveyors, it may be worth conducting a session or two on translation. If a survey has formal translations set up on electronic data collection tools, it may be sufficient to show trainees how to access these translations or switch between languages and to allow them some time to practice reading the translated versions aloud to one another. If formal translations cannot be used (e.g. because local languages are informal or mixed), surveyors may be required to translate the survey live. This situation can require significantly more training time. Again, practice and group work are very useful. It can also be important to have surveyors agree as a group on translations for key terms within the survey, allowable ways of asking certain question types (e.g., Likert scales) or on how to resolve any other issues that arise from group translation practice. This helps to encourage consistency in translation approach.

- Field protocols (mandatory--duration will depend on the nature of the protocols to be covered). This session should cover all field protocols related to the data collection activity. Some examples of these protocols are:

- Identifying field locations: For example, say we are to survey villages. We have a list of villages from administrative data, and we have selected the study villages already. However, we may not always have a map of the village beforehand. Sometimes villages can be spread out or can contain multiple hamlets. Surveyors should be trained on how to ensure that they have identified the village and its boundaries correctly. Surveyors may need to develop their map reading skills to find the households in the sample. J-PAL staff and affiliates: see an example exercise for a training session for map reading in an urban context.

- Permission from local leaders/officials: It is a good idea to obtain permission from relevant leaders or officials before beginning data collection. Senior members of your field team should be trained on this process. They should also be instructed to collect a permission letter if possible. All field team members should carry a copy of this letter (in the local language) in case households ask for it.

- Selecting respondents: This can differ based on the sampling method--whether or not a sample list already exists, or if you are planning to randomize in the field (see more on these topics in the randomization resource). The inclusion and exclusion criteria for selecting respondents must be clearly explained.

- For example, if the objective is to only survey households that do not have a private toilet at home, surveyors must be trained on not only the definition of a private toilet, but also how to ensure that the household does not have one--possibly by inspection. After the household has been identified, the next step might be to select the respondent to whom the survey must be administered. For example, if it is to be the head of the household, the surveyor must have clear instructions on the definition of a household head. This can be someone who makes household decisions and who resides at the house for at least 9 months in a year. Similarly, the team must also know how to define a household. These types of decisions can be complex and should be made by the PIs. The surveyor manual or survey itself should include clear and detailed instructions on selecting the respondent and identifying household members based on the criteria defined by the PIs of the study.

- Contacting hard-to-reach respondents: Specific protocols may be used in a given setting for minimizing attrition or trying to reach as many respondents as required to create a representative sample. These protocols might include information on how many times to try a household at different times of day or days of the week. For a phone survey, it might include when to try an alternative contact (after how many attempts) or how surveyors should manage their call allocations, between trying new respondents or those they have tried before.

- Safety: Training surveyors on the specific safety protocols used in the field is important. Ideas for establishing customized safety protocols for your study can be found under Field team management.

- Following up with respondents: When respondents refuse to answer, how much should surveyors insist? What to do? Who to contact?

- Knowledge assessment (highly recommended 1-2 hours depending on number of assessments needed). At this stage, it could be helpful to test trainees’ understanding of the survey instrument and field protocols. This step can help identify knowledge gaps and possible misunderstandings amongst trainees as well as identify high performers. Addressing identified problem areas early on can help prevent larger issues from arising in later stages of the data collection process.

- Develop an assessment that tests key concepts and modules in the survey instrument as well as field protocols that are essential for successful survey implementation.

- Administer the assessment after all relevant material is covered and trainees have had sufficient time to review the instrument and protocols.

- Post results relatively quickly, preferably on the day of the assessment. Electronic delivery and using simple multiple choice can make it easy to grade and release results. This can give you time to correct issues.

- Identify trainees with weak scores or areas that many trainees have difficulty with and cover those areas again with individuals or the whole group.

- If needed, you can retest specific individuals with weak scores or the entire group on key concepts or protocols.

- Give recognition to those who perform well to boost morale.

- Shorter, lighter touch quizzes can also be incorporated throughout the training as useful measures of surveyor’s understanding of the instrument. These quizzes can be used as end of day consolidation exercises or to break up more tedious sections of training.

- For example, surveyors can review a poorly filled out survey, and point out mistakes that they spot or they can be quizzed on their responses to various scenarios.

- Field practice (highly recommended--1-3 days): At the end of the training, a few days of field practice (i.e., enumerators find and interview people who are similar to the study sample) can be very helpful for trainees. Field practice can be an opportunity to test their adherence to field protocols and administration of the questionnaire. If you are able to include field practice, you should ensure that these days are scheduled with a classroom session in-between to allow for systematic feedback and opportunity to practice post-feedback The practice sessions should include as many elements as possible that the actual data collection activity will entail, such as identifying respondents, administering the survey, filling out tracking sheets, etc.

- Debrief: Be sure to debrief with the team after field practice. While the major goal of this is to provide feedback on their performance in the field, it is also an opportunity for the team to ask questions, provide feedback on the experience, and conduct a refresher training if necessary.

- Unfortunately, field practice is not always feasible. It can depend on the context of the study: for example, if participants and/or questions are too specific, it might be difficult to find a context that is similar to but not the same as the real one, or if the survey is tied to a specific event (such as an election), it may not be possible to practice at an earlier time. If the objective of the training is also to select the enumerators, field practice is the best way to assess the participants’ ability to administer the survey correctly. Take advantage of it!

- Dealing with adverse events (mandatory--around 2 hours): The field team must also be trained on the appropriate handling of adverse events while in the field. Examples of such events are accidents in the field, misconduct by respondents, safety threats, officials who are angry about the research team’s conduct, theft or attempted theft of equipment/incentives/other materials and broken data collection equipment, charges of sexual harassment, charges of asking questions that can incite trouble among different social groups in village, villagers being suspicious of male surveyors wanting to speak with women. In specific contexts, a de-escalation training may be useful. See the adverse event section of the IRB page for more information.

- J-PAL staff and affiliates: See an optional de-escalation session outline.

- Surveying children: If the data collection activity entails surveying young children, surveyors must be specially trained for such interactions. See also a guide to improving data quality while surveying children, as well as a guide to the ethics of surveying children.

- Measuring health outcomes: For projects collecting health outcomes, the survey team must also be adequately trained to collect health measures such as anthropometric indicators, or to collect blood samples. They must get clear instructions on the safe handling of devices and bodily fluids, and correctly noting readings. They may need to be trained on how to measure children (e.g. asking permission from parents and the child to touch the child).

- Miscellaneous

- Respondent tells surveyors about abuse. What should you do? Who to contact?

- Professional communication session (optional): A possible training that equips surveyors with skills beyond the project can also be implemented depending on the discretion of the project and PIs.

J-PAL Staff and affiliates: see sample training manuals as well as a presentation (and notes) from J-PAL Africa on professional communication.

Selecting successful candidates

Finally, if using the training as an opportunity to select candidates for the team, you should do so now, based on their performance during the training, particularly during field practice sessions. Training is also a good opportunity to look for things that may be helpful to better plan field activities.

- Identify "top performers"--in general, you want to hire the surveyors who perform the best, but you may need to take into consideration the gender composition (if the survey is gender-sensitive) and the language skills of the survey team (if working in a context with multiple languages).

- Identify "friends"--while teamwork is important, it may be best to create teams of people who are not "friends" from before. This helps ensure that people don’t goof off or try and cover for one another. This is also true for potential "romantic" connections!

Making training fun

An important goal of training is to ensure that the field team is motivated and capable of doing the data collection well. As the front line of our research, enumerators play a tremendously important role in ensuring the success of our research studies. Their motivation can affect the rate at which we survey. Their conduct can affect how happy our participants are to take part in this and future rounds of the study. Their understanding of the survey instrument and ability to capture data accurately directly impacts the quality of the data we gather and contributes to minimizing measurement error.

Making training fun and engaging can help to ensure that these goals are met. It can help maximize trainees’ attention and consolidate key lessons. It can also instill a strong sense of motivation, facilitate better interpersonal relationships in the field team, help surveyors feel invested in the study’s success and empowered to contribute useful ideas and insights from the field. Some guidelines for making training fun and engaging:

- Start with an ice-breaker: This can make new trainees feel comfortable, help build relationships between old and new fieldworkers, create a good rapport among different field team members and make people excited about working for you–this can be as simple as starting training with introductions in which trainees say who they are, where they are from and answer a fun question (e.g. favorite food, worst habit, a place they’d love to visit, something that reminds them of home, etc.). J-PAL staff and affiliates: See games and exercises that have worked well in the past.

- Ask a lot of questions: Training can be an exhausting experience for prospective surveyors. It’s easy to zone out for a short period and miss a key instruction. For important points, asking questions is a useful tool for getting surveyors’ brains ticking on a particular issue. For example, before presenting on ethical considerations, a trainer could ask "Can anyone think of reasons why it’s important to ask for consent?" or "How would you feel if a complete stranger asked you this [sensitive] question?" Other good questions are "Why do you think we ask this question?" or "Why do you think we ask you not to prompt here?" while practicing the survey. This works well in group role play.

- Reward trainees for participation: Specifying at the outset of training that your final selection of surveyors to hire will depend in part on participation in training and acknowledging participation throughout the training (e.g., remarking if a good question was asked) can help trainees to stay engaged, encourage them to ask questions on points that are unclear, and enable the trainer to judge the quality of their interactions.

- Use energizers and games: Short games and energizers can break up a day of lecturing, help with team-building and make for a fun experience for trainers and trainees alike. People-bingo or the alliterative name game can help participants get to know one another, while project-specific games (e.g. asking trainees to describe project/survey terms without using the word to their "team" who must guess the term) can be an innovative way to get participants to take in key concepts. Short energizers that get people out of their seats and to move around the room can wake up sleepy participants.

- Change the format regularly: Moving between lecture/classroom style, brainstorming sessions, and pair-work or group-work or quizzes is another useful way to prevent boredom and keep energy levels high.

- Have fun slides: Including a few jokey cartoons, funny quotes, or photos can increase enumerators' energy during training sessions--just don’t overdo it, or it will take away from your message rather than reinforcing it. After devising a training outline/agenda, look for times where concentration might be waning (e.g. after a detail-heavy session) and insert some of these practices at those points in the agenda. It is also useful to have a store of short energizers and games that can be used at any point. If, for example, your trainees’ attention is flagging on a particularly hot afternoon, a short game can wake everyone up enough to take in the rest of the day’s material. Providing refreshments can also boost engagement.

Last updated March 2021.

These resources are a collaborative effort. If you notice a bug or have a suggestion for additional content, please fill out this form.

Remote training

In-person surveys and training may not be feasible due to restrictions on movement. The training can be conducted using other platforms like phone conversations, video lectures, or video conferencing. J-PAL South Asia’s resource on remote training for phone surveys provides best practices for planning and conducting effective training programs. The appendices compare several platforms and provide a sample remote training schedule. The following best practices are drawn from this resource.

Best practices for planning a remote training:

- Do your homework on potential enumerators and ensure that they have the required equipment for phone surveys before they come into the training.

- Choose your training platform carefully. Get your training participants to familiarize themselves with the platform ahead of the actual training.

- Break the training plan into a number of small sessions to facilitate better comprehension and retention. See an example training agenda from a project..

- Build in enough time into the training schedule for mock sessions and team debriefs.

- Invest time in building training resources (videos, quizzes) to aid better understanding and retention of information.

- Train a small team of senior field staff ahead of the actual training and leverage their support in building resources and planning for the training.

Best practices for training effectively:

- Share sharp and concise resources that help training participants understand and apply what they learn during the training.

- Leverage technology to keep the participants engaged.

- Utilize quizzes on SurveyCTO/Google forms and demo recordings to identify knowledge gaps at the enumerator level as well as systematic gaps in understanding within the team for specific questions.

- Allocate time in the trainings to practice with each participant

- Pay additional emphasis on calling protocols, management of call attempts and soft skills for engaging with the respondent.

Additional training content for conducting phone surveys:1

- Train surveyors to identify the correct respondent. Based on the project’s directive, the surveyors might need to conduct the survey with a specific person in the household. That person might/might not be the one answering the call. Explain to surveyors the importance of conducting the survey with the target respondent and at the same time provide them with strategies to reach the designated member of the household.

- Phone surveys do not give the luxury of ensuring that the respondent’s attention isn’t diverted due to their immediate surroundings. Train surveyors to manage such situations.

- During phone surveys, at times, the respondent may consult other members present around them. Train and establish a protocol for surveyors to be able to identify the respondent’s final answer.

- Train surveyors to respond if the respondent hands over the phone to someone else mid-survey. This happens more often than you’d expect (especially if the survey is taking too long or the respondent feels they might not know the correct answer to questions being asked). Instituting a project-specific protocol in place and training the surveyors accordingly might help maintain the survey completion rate as well.

- If phone conversations are recorded (with IRB approval), train surveyors in enabling and using a recording app. One example is the Automatic Call Recorder (ACR) application.

Last updated March 2023.

We thank Ben Morse, Mike Gibson, and Sabhya Gupta for helpful comments. Any errors our own.

Adapted from J-PAL South Asia’s Transitioning to CATI checklist

Additional Resources

J-PAL Africa's De-Escalation Session (J-PAL internal resource)

J-PAL Africa's Mapwork Exercise (J-PAL internal resource)

J-PAL Africa's Particularly successful icebreakers (J-PAL internal resource)

J-PAL Africa's Professional communications lecture (J-PAL internal resource)

J-PAL Africa's Professional communications lecture notes (J-PAL internal resource)

J-PAL Africa's Template Device Check-Out Contract (J-PAL internal resource)

J-PAL's Field Manuals (J-PAL internal resource)

J-PAL South Asia's Best practices: Remote field staff training

J-PAL South Asia's Budgeting for phone surveys during the Covid-19 outbreak

Appendix A of J-PAL South Asia's Transitioning to CATI:Checklists and resources

Society for Research in Childhood Development's Ethical Standards for Research with Children

References

de Leeuw, Edith, 2011. "Improving data quality when surveying children and adolescents: Cognitive and social development and its role in questionnaire construction and pretesting" Report delivered at the Annual Meeting of the Academy of Finland. https://www.aka.fi/globalassets/awanhat/documents/tiedostot/lapset/presentations-of-the-annual-seminar-10-12-may-2011/surveying-children-and-adolescents_de-leeuw.pdf (direct download)