Search our database of 1,200+ summaries of randomized evaluations conducted by our affiliates in 100 countries. To browse key policy recommendations from a subset of these evaluations, visit the Policy Publications tab above.

- Bureaux

- Nous Connaître

- Secteurs

- Évaluations

-

Research Resources

- About Us

- Our Work

- Join ASPIRE

- Newsroom

- Pistes de Réflexion

- Des Résultats aux Politiques

-

Notre siège global est au Département d’Economie du Massachusetts Institute of Technology et nos bureaux régionaux sont basés dans les meilleures universités d’Afrique, d’Europe, d’Amérique latine et Caraïbes, du Moyen-Orient et l'Afrique du Nord, d’Amérique du Nord, d’Asie du Sud, et d’Asie du Sud-Est.

-

Notre siège global est au Département d’Economie du Massachusetts Institute of Technology et nos bureaux régionaux sont basés dans les meilleures universités d’Afrique, d’Europe, d’Amérique latine et Caraïbes, du Moyen-Orient et l'Afrique du Nord, d’Amérique du Nord, d’Asie du Sud, et d’Asie du Sud-Est.

-

Notre siège global est au Massachusetts Institute of Technology à Cambridge, États-Unis, et nos bureaux régionaux sont basés dans les meilleures universités d’Afrique, d’Europe, d’Amérique latine et Caraïbes, d’Amérique du Nord, d’Asie du Sud, et d’Asie du Sud-Est.

-

Basé à la Southern Africa Labour & Development Research Unit à l’Université du Cap en Afrique du Sud depuis 2010, J-PAL Afrique travaille à l’amélioration des programmes sociaux visant à réduire la pauvreté en Afrique subsaharienne.

-

Basé à la Pontificia Universidad Católica de Chile à Santiago depuis 2009, J-PAL Amérique Latine et Caraïbes s'efforce d'intensifier la lutte contre la pauvreté et d'améliorer la qualité de vie des plus pauvres en utilisant des données scientifiques pour guider les programmes sociaux.

-

J-PAL MENA is based at the American University in Cairo, Egypt.

-

Établit en 2007 à l'Institute for Financial Management and Research (IFMR) en Inde, J-PAL Asie du Sud vise à renforcer l'efficacité des programmes de lutte contre la pauvreté en apportant aux décideurs des données scientifiques probantes.

-

Ouvert en 2012 à l'Institute for Economic and Social Research de l’Universitas Indonesia, J-PAL Asie du Sud-Est exerce des activités de recherche, de renforcement des capacités et de diffusion de connaissances dans le domaine du développement et contribue à ce que les politiques publiques s'appuient sur des preuves scientifiques.

-

-

Le Laboratoire d'Action contre la Pauvreté, J-PAL, est un centre de recherche mondial qui œuvre à la réduction de la pauvreté en veillant à ce que les politiques sociales s'appuient sur des preuves scientifiques. S'appuyant sur un réseau de plus de 1,100 chercheurs affiliés dans des universités du monde entier, J-PAL mène des évaluations d'impact randomisées afin de répondre aux questions essentielles dans la lutte contre la pauvreté.

-

Le Laboratoire d'Action contre la Pauvreté, J-PAL, est un centre de recherche mondial qui œuvre à la réduction de la pauvreté en veillant à ce que les politiques sociales s'appuient sur des preuves scientifiques. S'appuyant sur un réseau de plus de 1,100 chercheurs affiliés dans des universités du monde entier, J-PAL mène des évaluations d'impact randomisées afin de répondre aux questions essentielles dans la lutte contre la pauvreté.

-

-

Nos chercheurs affiliés sont basés dans plus de 130 universités et effectuent des évaluations aléatoires dans le monde entier pour concevoir, évaluer et améliorer les programmes et les politiques qui visent à réduire la pauvreté. Ils définissent leurs propres agendas de recherche, collectent des fonds pour mener leurs évaluations et travaillent avec les équipes de J-PAL sur la recherche, la diffusion des résultats et la formation.

-

Le Conseil d'administration est responsable de l'orientation stratégique générale et contribue au développement des activités de recherche, de formation et de diffusion des résultats.

-

-

Our research, policy, and training work is fundamentally better when it is informed by a broad range of perspectives.

-

J-PAL initiatives concentrate funding and other resources around priority topics for which rigorous policy-relevant research is urgently needed.

-

Nous organisons des événements, conférences, séminaires en ligne et ateliers de formation dans le monde entier pour les chercheurs, les décideurs politiques et les acteurs de terrain.

-

Parcourez les articles de presse, médias en ligne, blogs, podcasts et videos sur notre travail et la recherche de nos affiliés, ainsi que nos communiqués et lettres d'information, par année.

-

Based at leading universities around the world, our experts are economists who use randomized evaluations to answer critical questions in the fight against poverty. Connect with us for all media inquiries and we'll help you find the right person to shed insight on your story.

-

-

Conseillé par des Chaires scientifiques, tous professeurs affiliés, nos secteurs guident les activitiés de recherche, de diffusion politiques et de formation. Ils gèrent les initiatives qui financent des évaluations randomisées et organisent des événements dans le monde entier.

-

Conseillé par des Chaires scientifiques, tous professeurs affiliés, nos secteurs guident les activitiés de recherche, de diffusion politiques et de formation. Ils gèrent les initiatives qui financent des évaluations randomisées et organisent des événements dans le monde entier.

-

Comment inciter les petits exploitants à adopter des pratiques agricoles éprouvées afin d’améliorer leurs rendements et leur rentabilité ?

-

Quelles stratégies plus humaines et moins coûteuses peut-on mettre en œuvre pour prévenir et faire reculer la criminalité et la violence ?

-

Comment garantir un enseignement de qualité qui permette aux élèves, mais aussi à leur famille et à leur communauté, de tirer tous les bénéfices de l’éducation ?

-

Comment améliorer l’accès à l’énergie, réduire la pollution et atténuer l’impact du changement climatique tout en renforçant nos capacités d’adaptation en la matière ?

-

Comment faire en sorte que les produits financiers soient plus abordables, plus adaptés et plus accessibles aux entreprises et aux ménages défavorisés ?

-

Comment les politiques concernant les entreprises du secteur privé influent-elles sur les écarts de productivité entre les pays à faibles revenus et les pays aux revenus élevés? Comment les politiques des entreprises elles-mêmes influent sur la croissance économique et le bien-être des travailleurs?

-

Comment pouvons-nous réduire les inégalités de genre et nous assurer que les programmes sociaux prennent en compte la dynamique existante entre les genres ?

-

Comment renforcer l’accès et la provision de services de soins de qualité, et promouvoir des comportements sains ?

-

Comment aider les individus à trouver et à conserver un emploi, notamment les jeunes qui entrent sur le marché du travail ?

-

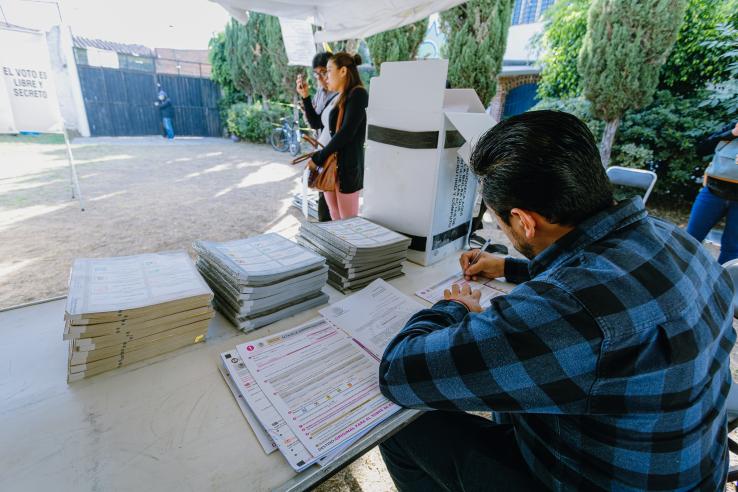

Quelles sont les causes et les conséquences d’une mauvaise gouvernance ? En quoi les politiques publiques peuvent-elles améliorer la provision de services publics ?

-

How can we identify effective policies and programs in low- and middle-income countries that provide financial assistance to low-income families, insuring against shocks and breaking poverty traps?

-